Even the most optimistic person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market.

Excluding central London which is another world, most commentators are saying prices will be affected by around 5%. So looking at the commentators’ thoughts in more detail, property values in Rotherham will be 5% lower than they would have been if we hadn’t voted to leave the EU.

As the average value of a property in the Rotherham Metropolitan Borough Council area is £121,700, this means property values are set to drop for the average Rotherham property by £6,100. Batten down the hatches, soup kitchens and mega recession here we come… it’s going to get rough…

…but before we all go into panic mode in Rotherham… the devil is always in the detail.

Look at the statement again. I have highlighted the relevant part: “Property values in Rotherham will be 5% lower than they would have been if we hadn’t voted to leave the EU”

Property values today, according to the Land Registry are 2.3% higher than a year ago in the Rotherham Metropolitan Borough Council area. The 12 months before that they rose by 1.54% and the 12 months before that, they rose by 3.5%. If we hadn’t voted to leave, I believe on these figures, we could have safely assumed Rotherham House prices would have been 2% higher by the summer of 2017.

… and that’s the point, we won’t see a house price crash in Rotherham, it’s just that house prices in a years time will be 3% lower than they are now (ie 2% less the 5% lower figure because of Brexit).

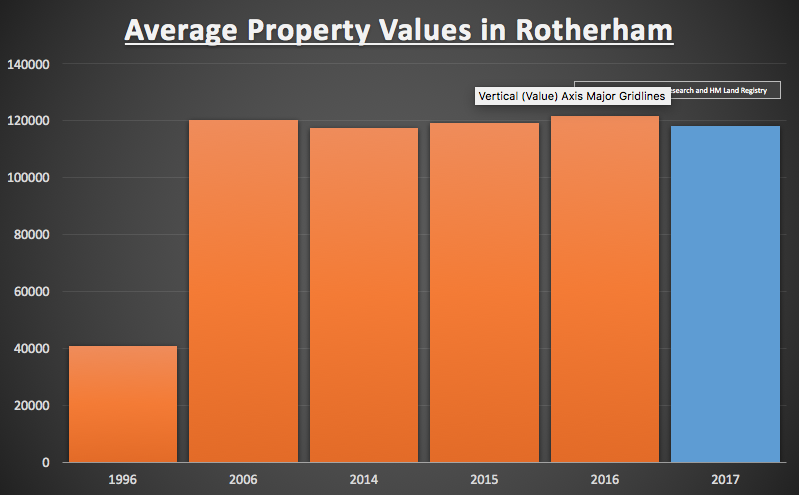

Let’s look at the historic figures and how that compares to today’s figures for the Rotherham Metropolitan Borough Council area and Rotherham as a whole.

Average Value of a property 20 years ago: £40,800

Average Value of a property 10 years ago: £120,200

Average Value of a property 2 years ago: £117,200

Average Value of a property 1 year ago: £119,000

Average Value of a property today: £121,700

Projected Value of a property in 12 months’ time: £118,100

Therefore, I believe the average value of a Rotherham property will be around £3,600 lower in 12 months’ time than today. As you can see below, this isn’t a significant change.

In 12 months time this is my considered opinion of where Rotherham property values will be. Looking at the historic prices, even if I (and many other property market commentators) are wrong and they drop 10% from TODAY’S figure, in the grand scheme of things, we have been through a lot in the last 20 to 30 years and Rotherham house prices have always bounced back.

Whilst the UK’s vote for Brexit has created an uncertainty in the Rotherham housing market, there is no need to panic and prospective buyers should merely use common sense about their purchases. I always say to people to be prudent and if you are taking out a mortgage, at some stage during the life of that mortgage, circumstances will be difficult. We won’t have a 2008 Credit crunch fire sale of properties because after the Mortgage Market Review which took place in the Spring of 2013, mortgage borrowers are not as highly leveraged this time around. As a result of this, with any luck there will not be too many distressed sales, which cause widespread price reductions.

…and Rotherham landlords? They have recently been thrashed by Osborne’s tax changes, but yields could rise if Rotherham house prices fall/stablise and rents grow, and this might also make it easier to obtain mortgages, as the income would cover more of the interest cost. If prices were to level or come down that could help Rotherham landlords add to their portfolio, as rental demand for Rotherham property is expected to stay strong as more people find it more and more difficult to obtain mortgages.

For more thoughts and insights into the Rotherham Property Market you can visit our Facebook page or follow us on Twitter.