“How much would it cost to buy all the properties in Rotherham?”

This fascinating question was posed by the 14-year-old son of one of my Rotherham landlords when they both popped into my offices before the Christmas break (doesn’t that seem an age away now!)

Over the Christmas break I decided to sit down and calculate the total value of all the properties in our town are worth. Just for fun I worked out how much they had gone up in value since this teenager was born in the autumn of 2002.

In the last 14 years, the total value of Rotherham property has increased by 93% (which is about £2.82 billion). This is a total of £5.85 billion!

This is interesting when consider the FTSE100 has only risen by 68.9% and inflation (i.e. the UK Retail Price Index) rose by 38.7% during the same 14 years.

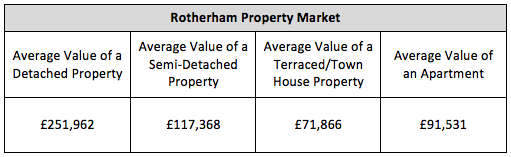

When I delved deeper into the numbers, the average price currently being paid by Rotherham households stands at £121,118. but you know me, I wasn’t going to stop there. When I split the property market down into individual property types in Rotherham, the average numbers come out like this:

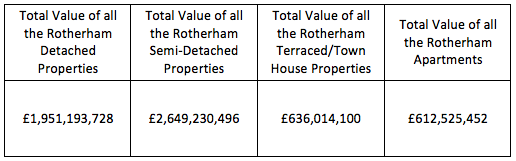

But it got even more fascinating when I multiplied the total number of each type of property by the average value!

Even though detached houses are so expensive, when you compare them with the much cheaper semi-detached houses, you can quite clearly see detached properties are no match in terms of total value of the semi-detached houses.

So, what does this all mean for Rotherham?

Well, as we enter the unchartered waters of 2017 and beyond, even though property values are already declining in certain parts of the previously overcooked London property market, the outlook in Rotherham remains relatively good. This is because over the last five years, the local property market was a lot more sensible than the market in central London.

Rotherham house values will remain resilient for several reasons.

- Demand for rental property remains strong with continued immigration and population growth.

- With 0.25% interest rates, borrowing has never been so cheap

- The simple lack of new house building – we have not kept up with current demand and there have been years and years of under investment

This all means only one thing – yes it might be a bumpy ride over the next 12 to 24 months but, in the medium term, property ownership and property investment in Rotherham has always, and will always, ride out the storm.

In the coming weeks, I will look in greater detail at my thoughts for the 2017 Rotherham Property Market. Stay up to date by following me on Twitter or Facebook.