Mar 8, 2017

Everyone should own their own home – that was the message of the Margaret Thatcher government.

In 1971, around 50% of people owned their own home. However, as the baby boomers got better jobs and pay, that proportion of homeowners rose to 69% in 2001. Homeownership was here to stay.

Thanks to TV programmes such as Homes Under The Hammer, baby boomers started to jump on the buy-to-let bandwagon – people in Rotherham invested in these properties as an investment. Now Rotherham first time buyers were in competition with the landlords to buy these smaller starter homes. This pushed up house prices in the 2000s (as mentioned in Part One). When combined with economics, banks and government policy, the prices are now beyond the reach of many first time buyers.

But are the Rotherham landlords fanning the flames of the housing crisis bonfire?

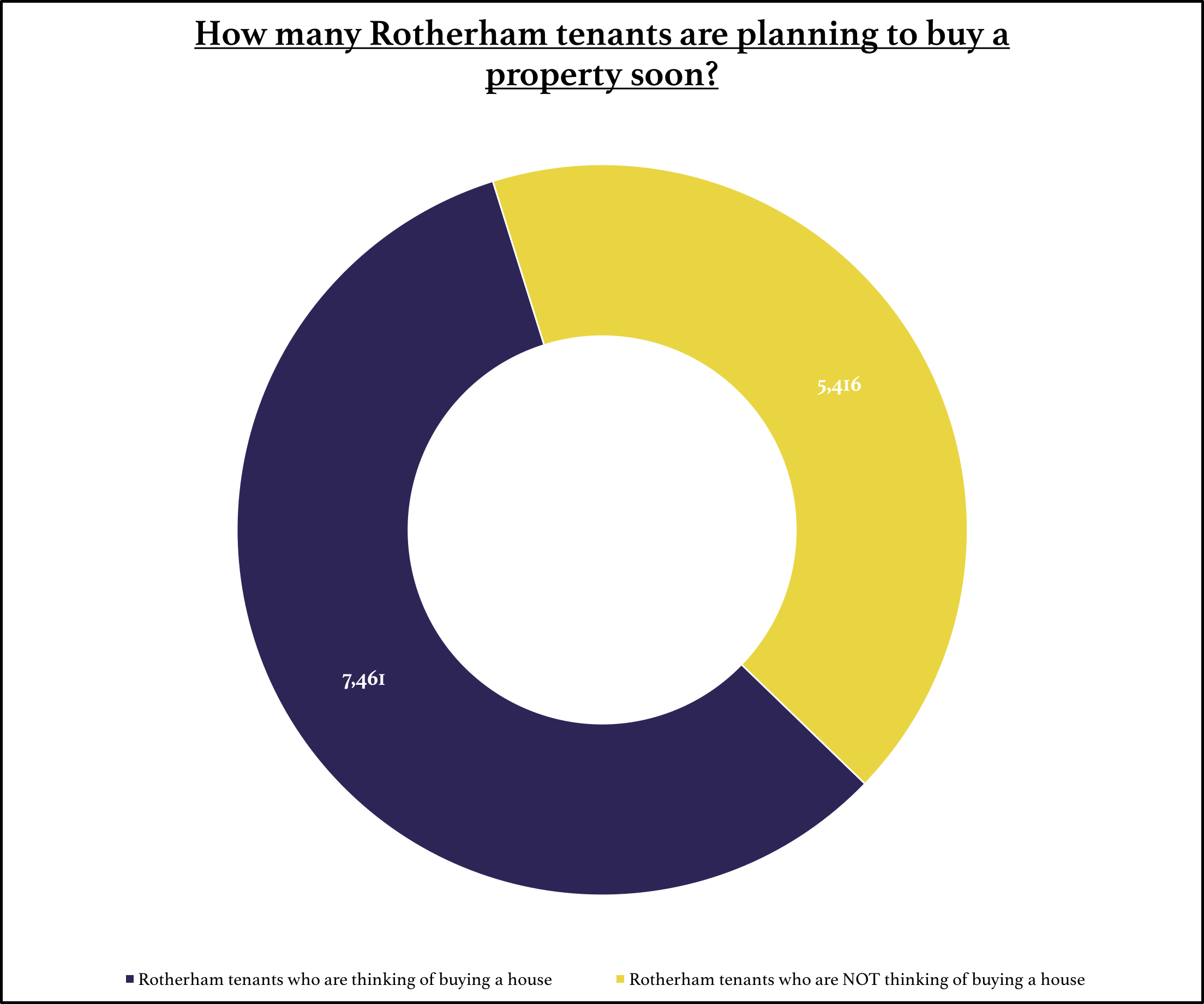

My opinion is that the landlords of the 5,416 Rotherham rental properties are not exploitive. In fact, they are making many positive contributions to Rotherham and the people who live here. Like I have said before, Rotherham (and the rest of the UK) isn’t building enough properties to keep up the demand caused by high birth rates, job mobility, growing population and longer life expectancy.

According to the Barker Review, for the UK to standstill and meet current demand, the country needs to be building 8.7 new households each and every year for every 1,000 households already built. Nationally, we are currently running at 5.07 per thousand and in the early part of this decade were running at 4.1 to 4.3 per thousand.

It doesn’t sound a lot of difference, but let us look at what this means for Rotherham …

For Rotherham to meet its obligation on the building of new homes, Rotherham would need to build 399 households each year.

Unfortunately we are missing that figure by around 167 households a year.

For the Government to buy the land and build those additional 167 households, it would need to spend £24,473,638 a year in Rotherham alone. Add up all the additional households required over the whole of the UK and the Government would need to spend  £23.31bn each year… I don’t know if you’ve noticed but the country hasn’t got that sort of money

£23.31bn each year… I don’t know if you’ve noticed but the country hasn’t got that sort of money

With these problems, it is the property developers who are buying the old run-down houses and office blocks which are deemed uninhabitable by the local authority, and turning them into new attractive homes. These are either rented privately to Rotherham families or to those people who need council housing because the local authority hasn’t got enough properties to go around.

The bottom line is that, as the population grows, there aren’t enough properties being built for everyone to have a roof over their head.

Rogue landlords do need to be put out of business, whilst tenants should expect a more regulated rental market, with greater security for them. The system should ensure that tenants can rely on good landlords providing them high standards in a safe and modernised home.

As in Europe, where most people rent rather than buy, it doesn’t matter who owns the house – all people want is a clean, decent roof over their head at a reasonable rent.

So only you, the reader, can decide if buy-to-let is immoral, but first let me ask this question:

If the private buy to let landlords had not taken up the slack and provided a roof over these people’s heads over the last decade… where would these tenants be living now?

The alternative doesn’t even bear thinking about!

Have you enjoyed my two part blog series on the buy-to-let market? Let me know on Twitter or Facebook.

Mar 4, 2017

Recent statistics published by the Office of National Statistics show that there are 267,704 private rented households in the UK that are occupied by people aged 65+ – that’s 4.39% of OAPs living in private rented property.

This got me thinking two things:

1. How many of these OAPs have always rented?

2. How many have sold up and become a tenant?

In retirement, selling up could of course make financial sense to the mature generation in Rotherham. It potentially allows them to liquidate the equity of their main home to enhance their retirement income.

I wanted to know why these older people rent and whether there was opportunity for the buy-to-let landlords of Rotherham?

The Prudential published a survey recently that said nearly six out of ten OAP renters had never owned a home. 20% OAP renters were required to sell up because of debt and only one in ten OAP renters sold their property to use the money to fund their retirement. (The remaining 10% of OAP renters were renting for other reasons.)

Life expectancy is making it important to fund retirement.

For someone living in Rotherham who is aged 65, the current life expectancy is 18 years for a man and 20.1 years for a woman (interesting when compared to the national average of 18.7 years and 21.1 years). Funding retirement is therefore increasingly important.

The burdens of financing a long retirement are being felt by many mature people of Rotherham. The state of play is not helped by rising living costs and ultra-low interest rates reducing returns for savers.

So, what of Rotherham?

Of the 12,660 households in Rotherham, whose head of the household is 65 or over, not surprisingly 7,892 of households were owned (62.34%) and 3,795 (29.98%) were in social housing. However, the figure that fascinated me was the 526 (4.15%) households that were in privately rented properties.

Talking to members of my team at Bricknells Rentals and Fenton Board, as well as other Rotherham property professionals, it seems that this figure is rising. This is only anecdotal evidence but I’m convinced that more and more OAPs are selling their large Rotherham homes and renting something more manageable.

Why is renting a good option for OAPs?

Selling a large home and moving into the rental market allows OAPs to release all of their equity from their old home. This equity can be gifted to grandchildren (allowing them to get on the property ladder), invest in plans that produce a decent income and all the while living the retired life that they want to live.

These Rotherham OAP renters know they have a fixed monthly expenditure and can budget accordingly with the peace of mind that their property maintenance and the upkeep of the buildings are included in the rent. Many landlords will also include gardening in the rent!

Renting is also more adaptable to the trials of being an OAP – the capability to move at short notice can be convenient for those moving into nursing homes, and it doesn’t leave family members panicking to sell the property to fund care-home fees.

Rotherham landlords should seriously consider low maintenance semi-detached bungalows on decent bus routes and close to doctor’s surgeries as a potential investment strategy to broaden their portfolio. Get it right and you will have a wonderful tenant, who if the property offers everything a mature tenant wants and needs, will pay top dollar in rent!

Landlords, do you need more tips? Get in touch with me – I’d be happy to help.

Mar 1, 2017

Can we blame the 55 to 70-year-old Rotherham citizens for the current housing crisis in the town?

Known as the ‘Baby Boomers’, these Rotherham people were born after WW2 when the country saw a massive rise in births as they slowly recovered from the economic hardships experienced during wartime.

Throughout the 1970s and 1980s, they experienced (whilst in their 20s, 30s and 40s) an unparalleled level of economic growth and prosperity throughout their working lifetime on the back of improved education, government subsidies, escalating property prices and technological developments. They have emerged as a successful and prosperous generation.

However, some have suggested these baby boomers have (and are) making too much money to the detriment of their children, creating a ‘generational economic imbalance’.

Mature people have benefitted from house-price growth while their children are forced either to pay massive rents or pay large mortgages.

Between 2001 and today, average earnings rose by 65%,

but average Rotherham house prices rose by 143.2%

The issue of housing is particularly acute with ‘Millennials’ – the young people born between the mid-1980s and the late 1990s. They’ve been shaped by the computer and internet revolution. These 18-30 years are finding as they enter early adult life that it is very hard to buy a property. These ‘greedy’ landlords are buying up all the property to rent out back to them at exorbitant rents… it’s no wonder Millennials are lashing out at buy-to-let landlords – they are seen as the greedy, immoral, wicked people who are cashing in on a social despair.

Like all things in life, we must look to the past to appreciate where we are now.

The three biggest influencing factors on the Rotherham (and UK) property market in the later half of the 20th Century were:

- The mass building of Council Housing in the 1950s/60s.

- The Conservative’s decision to sell most of those Council Houses off in the 1980s

- 15% interest rates in the early 1990’s which resulted in many houses being repossessed.

It was these major factors that underpinned the housing crisis we have today in Rotherham.

After the USA relaxed their bank’s lending criteria in 1995 to encourage banks to give mortgages to those in low wage neighbourhoods, Britain unsurprisingly followed suit. The viewpoint in the USA was that anyone (even someone on the minimum wage) should be able to buy a home. Banks and building societies in the UK relaxed their lending criteria and brought to the market 100% mortgages.

Roll the clock forward to today – we can observe those very same footloose banks from the early/mid-2000s now ironically reciting the Bank of England backed hymn-sheet of responsible lending. On every first time buyer mortgage application, they are now look at every single line on a 18-30 year old’s bank statement, asking if they are spending too much on socialising or holidays. No wonder the Millenials seem to be afraid to ask for a mortgage! And if they do ask, more often than not, after all that hassle, the answer is negative.

Conversely, there are unregulated buy-to-let mortgages. As long as you have a 25% deposit, a heartbeat, pass a few very basic yardsticks and have a reasonable job, the banks will literally throw money at you… for example, Virgin Money are offering 2.99% fixed for 3 years – so cheap!

In Part Two next week, I will continue this emotive article and show you some very interesting findings on why young people aren’t buying property anymore.

Here’s a short preview: it’s not what you think!

As always, you can catch up with me on Facebook and Twitter or get in touch via email.

Feb 27, 2017

The good old days of the 70s and 80s, eh…?

24% inflation, 17% interest rates, 3 day working week, 13% unemployment, power cuts … those were the days… but at least people could afford to buy their own home. Why aren’t those in their 20s and 30s buying in the same numbers as they were 30 or 40 years ago?

Blaming the credit crunch and global recession in 2008

Many blame the credit crunch and global recession in 2008, which did have an enormous impact on the Rotherham (and UK) housing market. The young first-time buyers discovered it challenging to assemble the monetary means to get on to the Rotherham property ladder – a problematic mortgage market, the perceived need for big deposits, reduced job security and declining disposable income – buying a house did not look like a worthwhile prospect.

However, I would say there has been something else at play other than the issue of raising a deposit – having sufficient income and rising property prices in Rotherham.

Whilst these are important factors and barriers to homeownership, I also believe there has been a generational change in attitudes towards home ownership in Rotherham (and across the UK).

Back in 2011, the Halifax did a survey of thousands of tenants and 19% of tenants said they had no plans to buy a home for themselves. A recent, almost identical survey of tenants, carried out by The Deposit Protection Service revealed that in late 2016 this figure had risen to 38.4% – many no-longer equated home ownership to success and believing renting to be better suited to their lifestyle.

Renting is an important part of the housing sector

I believe renting is a fundamental part of the housing sector, and a meaningful proportion of the younger adult members of the Rotherham population choose to be tenants as it better suits their plans and lifestyle.

Local Government in Rotherham (including the planners – especially the planners), land owners and landlords need an adaptable Rotherham residential property sector that allows the diverse choices of these Rotherham 20 and 30 year olds to be met.

This means, if we applied the same percentages to the current 12,877 Rotherham tenants in their 5,416 private rental properties… 4,945 tenants have no plans to ever buy a property – good news for landlords.

Interestingly, in the same report, just under two thirds (62%) of tenants said they didn’t expect to buy within the next year.

Does that mean the other third will be buying in Rotherham in the next 12 months?

Some will, but most won’t…

In fact, the Royal Institution of Chartered Surveyors (RICS) predicts that, by 2025, that the number of people renting will increase, not drop.

Yes, many tenants might hope to buy but the reality is different for the reasons set out above. The RICS predicts the number of tenants looking to rent will increase by 1.8 million households by 2025, as rising house prices continue to make home ownership increasingly unaffordable for younger generations.

So, if we applied this rise to Rotherham, we will in fact need an additional 2,321 private rental properties over the next eight years (or 290 a year). As a result the number of private rented properties in Rotherham is projected to rise to an eye watering 7,737 households.

It will be fascinating to see how this all plays out over the next few years.

Join me on this journey – as well as this blog I post my latest insights and thoughts on Twitter and Facebook.

Feb 24, 2017

This is the big picture: the number of people moving house in the UK has dropped by over a third during the last decade.

Over the last 12 months 1,061,557 properties were sold with a total value of £223.74bn. Compare this with ten years ago when 1,581,727 properties sold with a total value of £405.56bn.

Whether you are a landlord, homeowner or tenant, it’s always important to keep an eye on the Rotherham property market, not just from your point of view, but also from every player’s point of view.

Over the last 12 months, 2,338 properties have sold (and completed) in Rotherham, worth £333m. Interestingly the number of properties changing hands in Rotherham has also dropped when compared to a decade ago.

It might surprise you that first time buyers in 2017 will benefit from a slight decline in Rotherham buy-to-let investors.

Those looking to buy a home in the spring and summer of 2017 will face a far less competitive Rotherham property market than the same time of year in 2016, when the urgency to beat the buy-to-let stamp duty hike was in full swing.

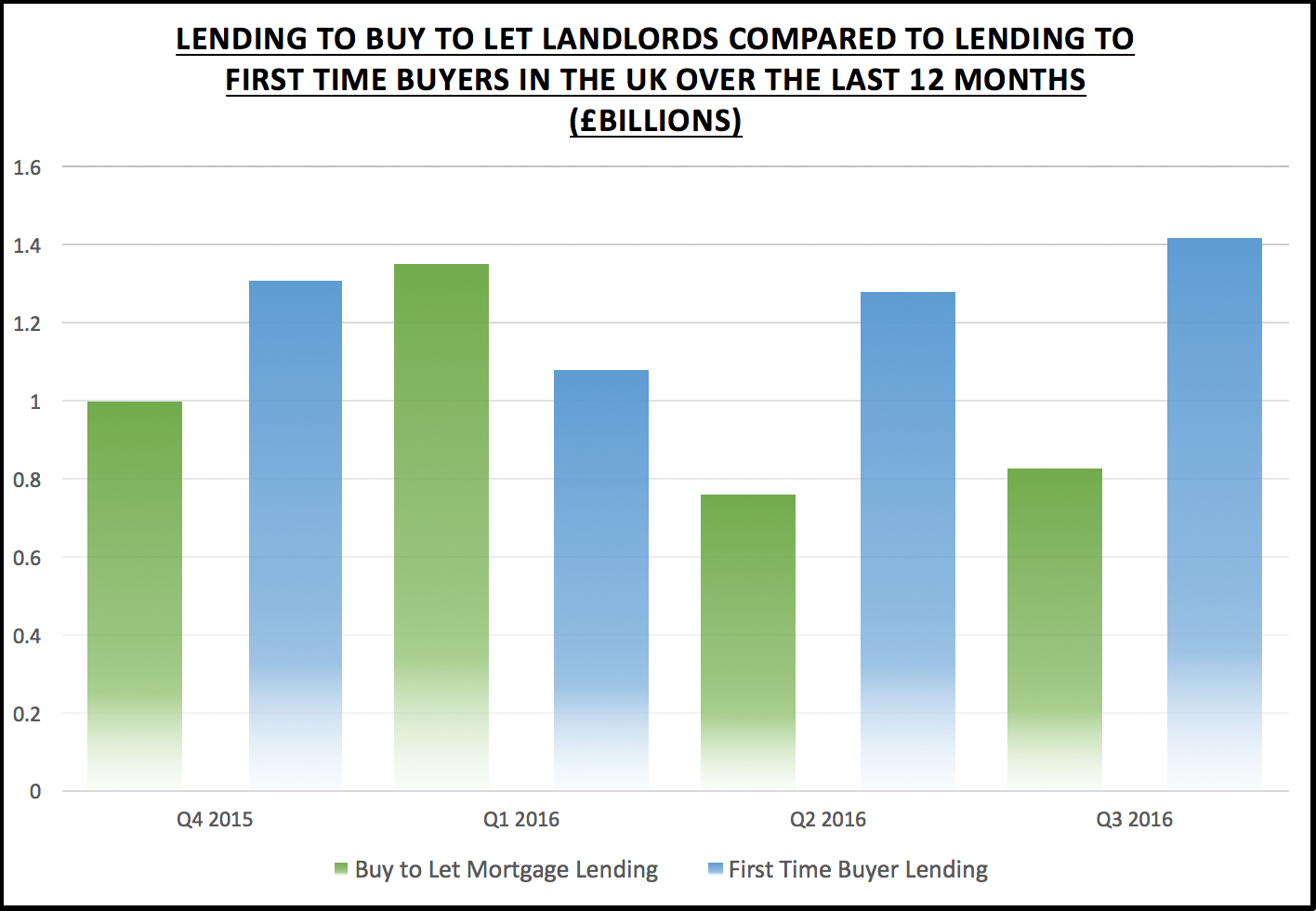

Many landlords brought forward their purchases to beat the tax, and since then, the number of buy-to-let purchases has dropped slightly. First time buyers have taken advantage of that and have increased their buying. In fact, looking at the Bank of England figures, this is what UK lenders have lent on buy-to-let properties versus first time buyers over the last 12 months:

Q4 2015: £1bn buy-to-let mortgages vs £1.31bn for first time buyers

Q1 2016: £1.35bn buy-to-let mortgages vs £1.08bn for first time buyers

Q2 2016: £760m buy-to-let mortgages vs £1.28bn for first time buyers

Q3 2016: £827m buy-to-let mortgages vs £1.42bn for first time buyers

When looking at the figures for Rotherham itself, first time buyers have borrowed more than £112.3m in the last 12 months to buy their first home.

This is a ringing endorsement of their confidence in their jobs and the local Rotherham economy. Those in their 20s and 30s who are considering being first time buyers in 2017 will find that the number of properties on the market has never been as good as it has for quite a while, meaning you have more choice of properties and less competition from so many buy-to-let landlords than a year ago.

Rightmove announced nationally that new seller enquiries are 26% up on the same time last year giving the stoutest indication that we may see a slight ease in the lack of properties on the market. When I look at the Rotherham market, at this moment in time there are an impressive 832 properties for sale, so plenty of choice. All this will be welcome news amongst Rotherham first-time buyers with a combination of a proportional reduction in new investors and landlords.

2017 is proving to be an interesting year for all homeowners, be they buy-to-let landlords, existing homeowners or future homeowners.

Stay up-to-date with all the latest within Rotherham’s property market by following me on Twitter and Facebook.

Feb 16, 2017

There’s a potential blessing in disguise for Rotherham landlords.

If I were a buy-to-let landlord in Rotherham today, I might feel a little bruised by the assault made on my wallet in the last 12 months by HM Treasury’s tax changes on buy-to-let.

To add insult to injury, Brexit has caused a tempering of the Rotherham property market with property prices not increasing by the levels we have seen in the last few years. I think we might even see a very slight drop in property prices this year and, if Rotherham property prices do drop, the downside to that is that first time buyers could be attracted back into the Rotherham property market – this means less demand for renting which means rents will go down.

Yet, before we all run for the hills, all these things could be serendipitous for every Rotherham landlord.

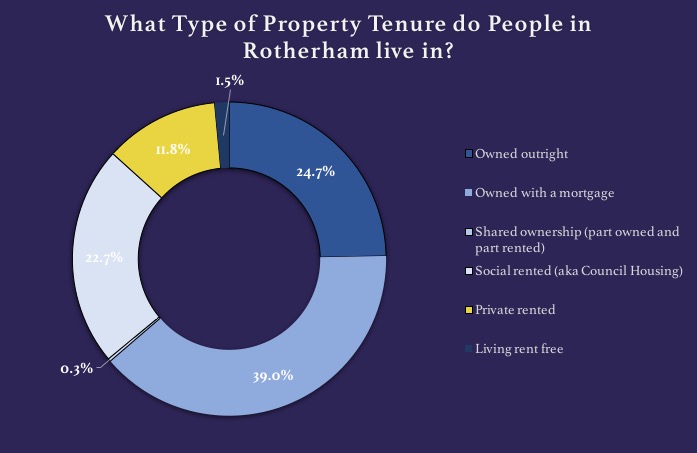

Rotherham has a population of over 100,000, so when I looked at the number of people who lived in private rented accommodation, the numbers were quite interesting:

11.8% is a significant proportion of the market and includes 12,877 occupiers according to the last census. Now, if property values were to level off or come down that could help Rotherham landlords add to their portfolio. Remember that yields will rise if Rotherham property prices fall, which will also make it easier to obtain a buy-to-let mortgage. The income would cover more of the interest cost.

Rental demand in Rotherham is expected to stay solid and may even see an improvement if uncertainty is protracted.

However, there is something even more important that Rotherham landlords should be aware of: the change in the anthropological nature of the potential first time buyers in their 20s.

How generational changes might impact the buy-to-let market

I have just come back from a visit to my wife’s relations after a family get together. I got chatting with my wife’s nephew and his partner. Both are in their mid/late twenties, both have decent jobs in Rotherham and they rent.

Yet, here was the bombshell: they were planning to rent for the foreseeable future. They had no plans to even save for a deposit, let alone buy a property.

I enquired why they weren’t planning to buy? The answers surprised me and they will surprise you too.

Firstly, they don’t want to put cash into property – spending money on living, socialising, holidays and technological gadgets is much more of a priority for this generation. Secondly, they want the flexibility to live where they choose and finally, they don’t like the idea of paying for repairs.

Apparently all their friends feel the same.

I was quite taken aback that buying a house is just not top of the list for these youngsters.

So, if 11.8% of Rotherham people are in rented accommodation and if that figure grows over the next decade as expected…

Now might just be a good time to buy property in Rotherham.

And if you have money, what else are you going to invest in? You can get involved in the tumultuous stock markets run by sharpe suited whizz kids… but property is a real investment – something that you can touch! There is nothing like bricks and mortar!

For more views and opinions on the property market here in Rotherham you can catch up with my other blogs. I would also love for you to get in touch with me. Finally, you can always follow me on Facebook or Twitter to get the most up-to-date information.

Page 15 of 25« First«...10...1314151617...20...»Last »

£23.31bn each year… I don’t know if you’ve noticed but the country hasn’t got that sort of money

£23.31bn each year… I don’t know if you’ve noticed but the country hasn’t got that sort of money