Sep 9, 2016

What has the plight of the Rotherham savers to do with the Rotherham property market…? The answer is “everything”.

Read the newspapers and you will see that every financial wizard is stating that the decision taken by the Bank of England’s Monetary Policy Committee in early August to cut the base interest rate to an all time low of 0.25% will mean most likely mean that they will stay low well into the early 2020s.

Savers must prepare themselves.

This isn’t some made up story to capture the headlines of newspaper editors. The yield (posh word for interest rate or return) on 10-year Government bonds is currently 0.61%. This indicates that the money markets believe that the Bank of England’s base rate will, on average over the next ten years, be below the 0.61% rate they are buying the 10 year bonds at (because they would lose money if the average was over 0.61%).

UK Interest rates are going to be low for a long time.

For those who have saved throughout their working lives and are looking for ways to maximise their savings, tying their money into property could prove advantageous.

You see as a saver, I did a search of the internet and the best savings rate I could find was a 5 year fixed rate at 2.5% a year with Weatherbys Bank. Your £200,000 nest egg would earn you £5,000 a year – not much.

However, on the other side of the fence, growth in Rotherham house prices and princely buy to let yields have made property investment in Rotherham an appealing option for many.

According to my research…

The average yield over the last five years for Rotherham buy-to-let property has been 5.2% a year and average property values over the same period have risen by 16.3%.

Using these averages, the Rotherham landlord’s property would be worth £232,600 and they would have received a total of £52,000 in rent – making the total return £284,600.

Meanwhile, whilst the 10,438 savers in Rotherham, (using the average savings rates for the last 5 years, even if they had reinvested the interest) their £200,000 would only grow to £221,184.

There are risks as well as benefits to buy-to-let though.

As my blog readers know, I tell it like it is and investing in buy-to-let means locking up capital in a property that may fall in value. Another option would be stock market income based investment funds, which are paying around 5%, especially if put your nest egg into a tax free Stocks & Shares ISA.

One last thought though…

You cannot buy an unloved ‘stock market income based investment fund’ and set about renovating it and adding value yourself. It isn’t bricks and mortar and that is why my fellow Rotherham homeowners and Rotherham landlords is why the British love affair with property will continue.

If you are considering becoming a new buy-to-let landlord in Rotherham, I can help you out. Get in contact with me and follow me on Facebook and Twitter for the latest Rotherham property market news.

Sep 2, 2016

I had an interesting chat with a Moorgate landlord who owns a few properties in the town. He popped his head in to my office as his wife was shopping in the area. We had never spoken before (because he uses another agent in the town to manage his Rotherham properties) yet after reading the Rotherham Property Blog for a while, the landlord wanted to know my thoughts on how the recent interest rate cut would affect the Rotherham property market.

I would also like to share these thoughts with you.

It’s been a few weeks now since interest rates were cut to 0.25% by the Bank of England as the Bank believed Brexit could lead to a materially lower path of growth for the UK, especially for the manufacturing and construction industries. You see for the country as a whole, the manufacturing and construction industries are still performing well below the pre-credit crunch levels of 2008/09, so the British economy remains highly susceptible to an economic shock.

This is especially important in Rotherham, because even though we have had a number of local success stories in manufacturing and construction, a large number of people are employed in these sectors.

In Rotherham, of the 46,524 people who have a job, 6,384 are in the manufacturing industry and 4,071 in Construction meaning

13.7% of Rotherham workers are employed in the Manufacturing Sector and 8.8% of Rotherham workers are in construction.

The other sector of the economy the Bank is worried about, and an equally important one to the Rotherham economy, is the Financial Services industry. Financial Services in Rotherham employ 1,346 people, making up 2.9% of the Rotherham working population.

Together with a cut in interest rates, the Bank also announced an increase in the quantity of money via a new programme of Quantitative Easing to buy £70bn of Government and Private bonds. Now that won’t do much to the Rotherham property market directly.

However, another measure also included in the recent announcement was £100bn of new funding to banks. This extra £100bn will help the banks pass on the base rate cut to people and businesses, meaning the banks will have lots of cheap money to lend for mortgages…

This will have a huge effect on the Rotherham property market.

That £100bn would be enough to buy half a million homes in the UK.

It will take until early in the New Year to find out the real direction of the Rotherham property market and the effects of Brexit on the economy as a whole, the subsequent recent interest rate cuts and the availability of cheap mortgages.

It will take until early in the New Year to find out the real direction of the Rotherham property market and the effects of Brexit on the economy as a whole, the subsequent recent interest rate cuts and the availability of cheap mortgages.

However, something bigger than Brexit and interest rates is the inherent undersupply of housing (something I have spoken about many times on this blog and the specific impact on Rotherham). The severe undersupply means that Rotherham property prices are likely to increase further in the medium to long term, even if there is a dip in the short term. This only confirms what every homeowner and landlord has known for decades…

Investing in property is a long term project. As an investment vehicle, it will continue to outstrip other forms of investment due to the high demand for a roof over people’s heads and the low supply of new properties being built.

For more thoughts and insights into the Rotherham Property Market you can visit our Facebook page or follow us on Twitter.

Aug 31, 2016

A few weeks ago I was asked a fascinating question by a local Councillor who, after reading the Rotherham Property Blog, emailed me and asked whether Rotherham landlords are meeting the challenges of tenanted families bringing up their families in Rotherham.

What interesting question to be asked.

Irrespective of whether you are tenant or a homeowner, the most important factors are security and stability in the home when bringing up a family. A great bellwether of that security and stability in a rented property is whether tenants are constantly being evicted. Many tenancies last just six months with families at risk of being thrown out after that with just two months’ notice for no reason.

Some politicians keep saying we need to deal with the terrible insecurity of Britain’s private rental market by creating longer tenancies of 3 or 5 years instead of the current six months.

However, the numbers seem to be telling a different story.

The average length of residence in private rental homes has risen in the last 5 years from 3.7 years to 4 years (a growth of 8.1%), which in turn has directly affected the number of renters who have children.

In fact, the proportion of private rented property that have dependent children in them, has gone from 29.1% in 2003 to 37.4% today.

Looking specifically at the S60 area of Rotherham compared to the National figures, of the 2,182 private rental homes in Rotherham, 787 of these have dependent children in them (or 36.1%), which is below the national average of already stated 37.4%.

Even more fascinating are the other tenure types in Rotherham…

- 9% of Social (Council) Housing in Rotherham have dependent children

- 49% of Rotherham Owner Occupiers (with a Mortgage) have dependent children

- 6% of Owner Occupiers (without a Mortgage) have dependent children

When we look at the length of time these other tenure types have, whilst the average length of a tenancy for the private rented sector is 4 years, it is 11.4 years in social (council) housing, 24.1 years for home owners without a mortgage and 10.4 years of homeowners with mortgages.

Anecdotally I have always known this, but this just proves landlords do not spend their time seeking opportunities to evict a tenant as the average length of tenancy has steadily increased. This noteworthy 8.1% increase in the average length of time tenants stay in a private rented property over the last 5 years, shows tenants are happy to stay longer and start families.

So, as landlords are already meeting tenants’ wants and needs when it comes to the length of tenancy, I find it strange some politicians are calling for fixed term 3 and 5 year tenancies.

Such heavy handed regulation could stop landlords renting their property out in the first place, cutting off the supply of much needed rental property, meaning tenants would suffer as rents went up. Also, if such legislation was brought in, tenants would lose their ‘Get Out of Jail card’ – under current rules, they can leave at anytime with one month’s notice not the three or six month tenant notice suggested by some commenters.

Finally, there is an extra piece of good news for Rotherham tenants. The English Housing Survey notes that those living in private rented housing for long periods of time generally paid less rent than those who chopped and changed.

Aug 24, 2016

Let me speak frankly. Even with Brexit and the reality immigration numbers will now potentially reduce in the coming years, there is an unending and severe shortage of new housing being built in the Rotherham area (and the UK as a whole).

Even if there are short term confidence trembles fueled by newspapers hungry for bad news, the ever growing population of Rotherham with its high demand for property versus curtailed supply of properties being built. This imbalance of supply/demand and the possibility of even lower interest rates will underpin the property market.

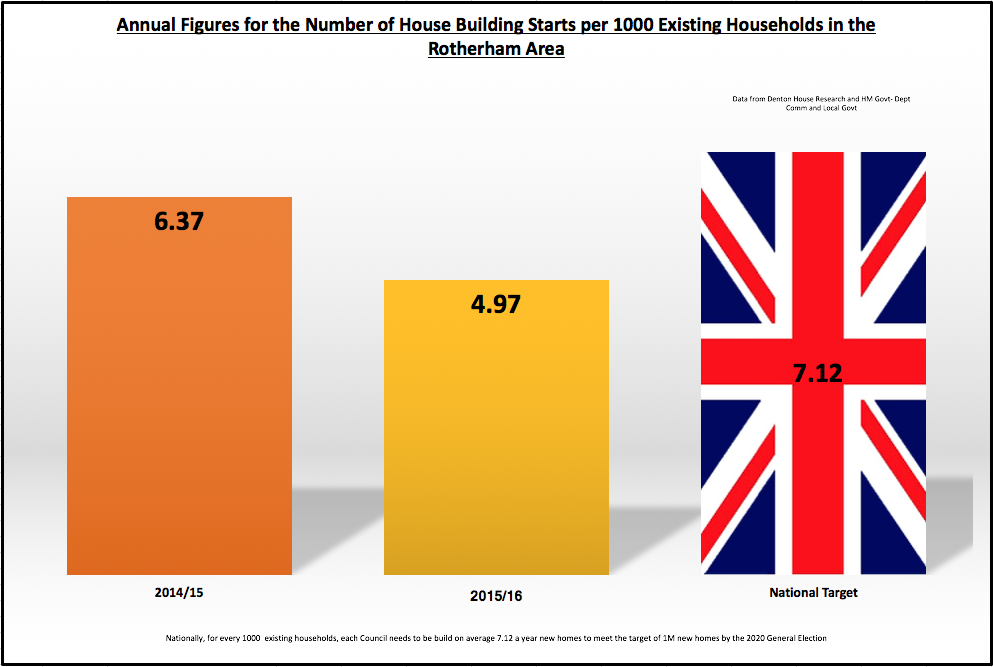

When the Tories were elected in 2015, Mr. Cameron vowed to build 1,000,000 new homes by 2020. If we as a country hit those levels of building, most academics stated the UK Housing market would balance itself as the increased supply of property would give a chance for the younger generation to buy their own home as opposed to rent. However, the up-to-date building figures show that in the first three months of 2016 building starts were down. Nationally, there were 35,530 house building starts in the first quarter, a long way off the 50,000 a quarter required to hit those ambitious targets.

Looking closer to home, over the last 12 months, new building in the Rotherham Metropolitan Borough Council area has slumped. In 2014/15, for every one thousand existing households in the area, an additional 6.37 homes were built. For 2015/16, that figure is now only 4.97 homes built per thousand existing households. Nationally, to meet that 1,000,000 new homes target, we need to be at 7.12 new homes per thousand.

over the last 12 months, new building in the Rotherham Metropolitan Borough Council area has slumped. In 2014/15, for every one thousand existing households in the area, an additional 6.37 homes were built. For 2015/16, that figure is now only 4.97 homes built per thousand existing households. Nationally, to meet that 1,000,000 new homes target, we need to be at 7.12 new homes per thousand.

To put those numbers into real chimney pots, over the last 12 months, in the Rotherham Metropolitan Borough Council area,

- 510 Private Builders (e.g. New Homes Builders)

- 40 Housing Association

- 0 Local Authority

These new house building numbers are down to the fact that not enough is being done to fix the broken Rotherham housing market. We are still only seeing 550 new homes being built per year in the area, when we need 788 a year to even stand still!

I am of the opinion Cameron and Osborne focused their attention too much on the demand side of the housing equation, using the Help to Buy scheme and low deposit mortgages to convert the Generation Rent (i.e. Rotherham ‘20 somethings’ who are set to rent for the rest of their lives) to Generation Buy. I would strongly recommend the new Housing Minster, Gavin Barwell, should concentrate the Government’s efforts on the supply side of the equation. There needs to be transformations to planning laws, massive scale releases of public land and more investment, as more inventive solutions are needed.

However, ultimate responsibility has to rest on the shoulders of Theresa May. Whilst our new PM has many plates to spin, evading the housing crisis will only come at greater cost later on. What a legacy it would be if it was Theresa May who finally got to grips with the persistent and enduring shortage of homes to live in. The PM has already stated that “need to do far more to get more houses built” and stop the decline of home ownership. However, she has also ruled out any changes to the green belt policy – something I will talk about in the future.

Hopefully these statistics will raise the alarm bells again and persuade both residents and councillors in Rotherham area that housing needs to be higher on its agenda.

In the meantime, for more thoughts and opinion on property in Rotherham please follow us on Twitter and Facebook.

Aug 15, 2016

The orthodox way of classifying property in the UK is to look at the number of bedrooms rather than its size in square metres (although now we are leaving the EU – I wonder if we can go back to feet and inches?).

It seems that homeowners and tenants are happy to pay for more space. It’s quite obvious, the more bedrooms a house or apartment has, the bigger it is likely to be.

The reason is not only due to the actual additional bedroom space, but the properties with more bedrooms tend to have larger / more reception (living) rooms. However, if you think about it, this isn’t so astonishing given that properties with more bedrooms would typically accommodate more people and therefore require larger reception rooms.

In today’s property market in Rotherham, the homeowners and landlords I talk to are always asking me which attributes and features are likely to make their property comparatively more attractive and which ones may detract from the price. Over time, buyers’ and tenants’ wants and needs have changed.

In Rotherham, location is still the No. 1 factor affecting the value of property, and a property in the best neighbourhoods, such as Scholes Village or Moorgate can command a price nearly 50% higher than a similar house in an ‘average’ area. However, after location, the next characteristic that has a significant influence on the desirability, and thus price, of property is the number of bedrooms and the type (i.e. Detached/ Semi/Terraced/Flat).

In previous articles, I have analysed the Rotherham housing stock into bedrooms and type of property, but never before now have I cross-referenced type against bedrooms. These figures for the Rotherham Metropolitan Borough Council area make fascinating reading. It shows 85.9% of all properties in the area have 3 or more bedrooms

| | Detached | Semi-detached | Terraced (including end-terrace) | Flat |

| 1 bedroom | 25 | 145 | 75 | 222 |

| 2 bedrooms | 409 | 3,057 | 3,356 | 695 |

| 3 bedrooms | 3,667 | 22,606 | 7,506 | 326 |

| 4 bedrooms | 6,093 | 4,280 | 1,327 | 63 |

| 5 or more bedrooms | 1,407 | 1,182 | 228 | 13 |

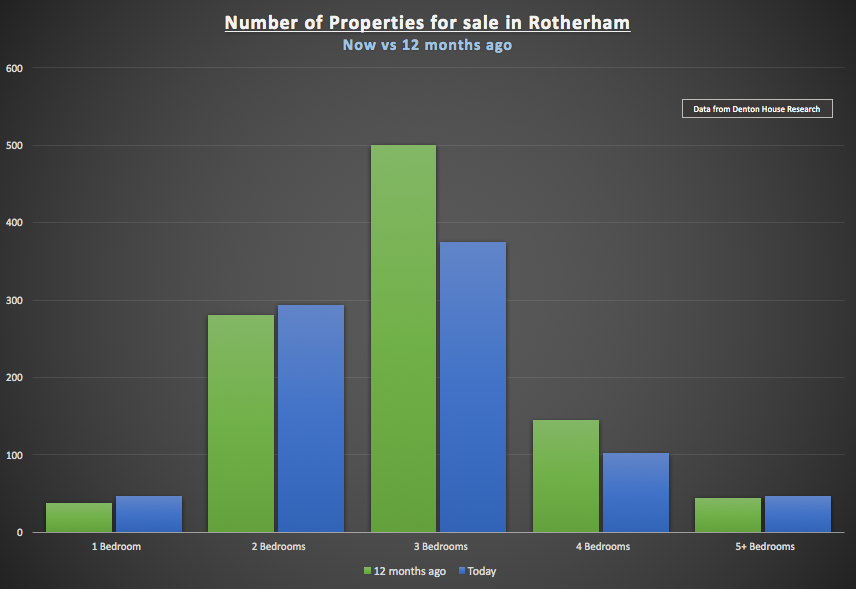

I was genuinely surprised at the low numbers of one and two bed properties – particularly two bed semis detached houses. This is especially notable as tenants like the smaller one and two bed properties in Rotherham. It might interest the homeowners and landlords of Rotherham, that there has been a change in the numbers of properties on the market and the split in bedrooms on the market over the last 12 months:

- 12 months ago, 38 one bed properties were for sale in Rotherham; today there is 46 – a rise of 21%

- 12 months ago, 280 two bed properties were for sale in Rotherham; today there is 293 – a rise of 5%

- 12 months ago, 501 three bed properties were for sale in Rotherham; today there is 375 – a drop of 25%

- 12 months ago, 145 four bed properties were for sale in Rotherham; today there is 102 – a drop of 30%

- 12 months ago, 44 five + bed properties were for sale in Rotherham; today there is 46 – a rise of 5%

For several years Rotherham buy-to-let investors have been the only buyers at the lower end (starter homes) of the market, as they have been enticed by high tenant demand and attractive returns. Some Rotherham landlords believe their window of opportunity has started to close with the new tax regime for landlords, whilst it already appears to be opening wider for first-time buyers. This is great news for first time buyers.

One final note for Rotherham landlords – all is not lost! You can still pick up bargains, you just need to be a lot more savvy and do your homework… one source of such information is this blog but you could also follow us on Twitter and Facebook for up-to-date insights into the Rotherham property market.

Aug 11, 2016

Even the most optimistic person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market.

Excluding central London which is another world, most commentators are saying prices will be affected by around 5%. So looking at the commentators’ thoughts in more detail, property values in Rotherham will be 5% lower than they would have been if we hadn’t voted to leave the EU.

As the average value of a property in the Rotherham Metropolitan Borough Council area is £121,700, this means property values are set to drop for the average Rotherham property by £6,100. Batten down the hatches, soup kitchens and mega recession here we come… it’s going to get rough…

…but before we all go into panic mode in Rotherham… the devil is always in the detail.

Look at the statement again. I have highlighted the relevant part: “Property values in Rotherham will be 5% lower than they would have been if we hadn’t voted to leave the EU”

Property values today, according to the Land Registry are 2.3% higher than a year ago in the Rotherham Metropolitan Borough Council area. The 12 months before that they rose by 1.54% and the 12 months before that, they rose by 3.5%. If we hadn’t voted to leave, I believe on these figures, we could have safely assumed Rotherham House prices would have been 2% higher by the summer of 2017.

… and that’s the point, we won’t see a house price crash in Rotherham, it’s just that house prices in a years time will be 3% lower than they are now (ie 2% less the 5% lower figure because of Brexit).

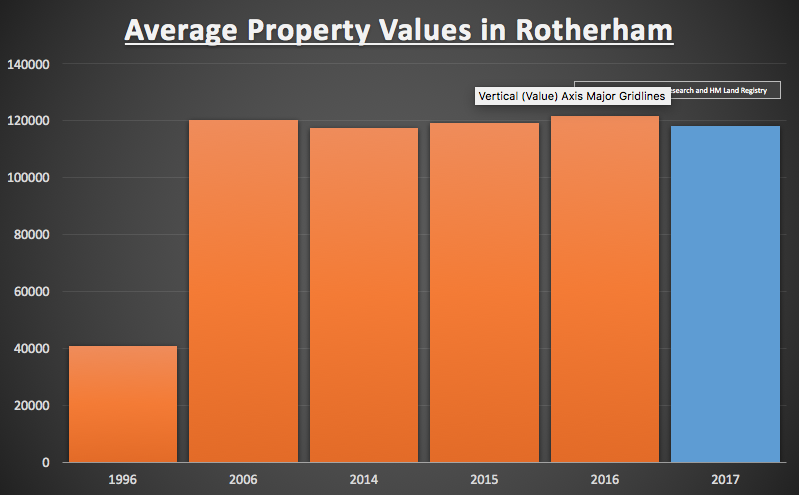

Let’s look at the historic figures and how that compares to today’s figures for the Rotherham Metropolitan Borough Council area and Rotherham as a whole.

Average Value of a property 20 years ago: £40,800

Average Value of a property 10 years ago: £120,200

Average Value of a property 2 years ago: £117,200

Average Value of a property 1 year ago: £119,000

Average Value of a property today: £121,700

Projected Value of a property in 12 months’ time: £118,100

Therefore, I believe the average value of a Rotherham property will be around £3,600 lower in 12 months’ time than today. As you can see below, this isn’t a significant change.

In 12 months time this is my considered opinion of where Rotherham property values will be. Looking at the historic prices, even if I (and many other property market commentators) are wrong and they drop 10% from TODAY’S figure, in the grand scheme of things, we have been through a lot in the last 20 to 30 years and Rotherham house prices have always bounced back.

Whilst the UK’s vote for Brexit has created an uncertainty in the Rotherham housing market, there is no need to panic and prospective buyers should merely use common sense about their purchases. I always say to people to be prudent and if you are taking out a mortgage, at some stage during the life of that mortgage, circumstances will be difficult. We won’t have a 2008 Credit crunch fire sale of properties because after the Mortgage Market Review which took place in the Spring of 2013, mortgage borrowers are not as highly leveraged this time around. As a result of this, with any luck there will not be too many distressed sales, which cause widespread price reductions.

…and Rotherham landlords? They have recently been thrashed by Osborne’s tax changes, but yields could rise if Rotherham house prices fall/stablise and rents grow, and this might also make it easier to obtain mortgages, as the income would cover more of the interest cost. If prices were to level or come down that could help Rotherham landlords add to their portfolio, as rental demand for Rotherham property is expected to stay strong as more people find it more and more difficult to obtain mortgages.

For more thoughts and insights into the Rotherham Property Market you can visit our Facebook page or follow us on Twitter.

over the last 12 months, new building in the Rotherham Metropolitan Borough Council area has slumped. In 2014/15, for every one thousand existing households in the area, an additional 6.37 homes were built. For 2015/16, that figure is now only 4.97 homes built per thousand existing households. Nationally, to meet that 1,000,000 new homes target, we need to be at 7.12 new homes per thousand.

over the last 12 months, new building in the Rotherham Metropolitan Borough Council area has slumped. In 2014/15, for every one thousand existing households in the area, an additional 6.37 homes were built. For 2015/16, that figure is now only 4.97 homes built per thousand existing households. Nationally, to meet that 1,000,000 new homes target, we need to be at 7.12 new homes per thousand.