Jul 10, 2020

What have we learned in the first month?

From talking to most of the Rotherham estate and letting agents and our own findings, it might surprise many of you that new enquiries from homebuyers, tenants, landlords and home sellers have been at record levels since lockdown was lifted from the property market in mid-May.

There are a number of reasons for this. Firstly, we had the pent-up demand for Rotherham property from the Boris Bounce in January and February. Next, many Rotherham people were planning to move this spring yet were prevented doing so because of lockdown, and finally, surprisingly, an advance wave of home movers seeking to bring their Rotherham moving plans forward because of a fear of a second Covid-19 wave later in the year.

So, what does all that look like and how does it compare to the last 12/18 months?

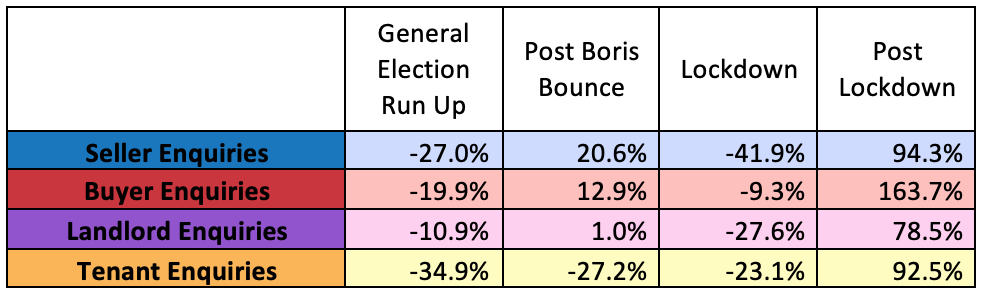

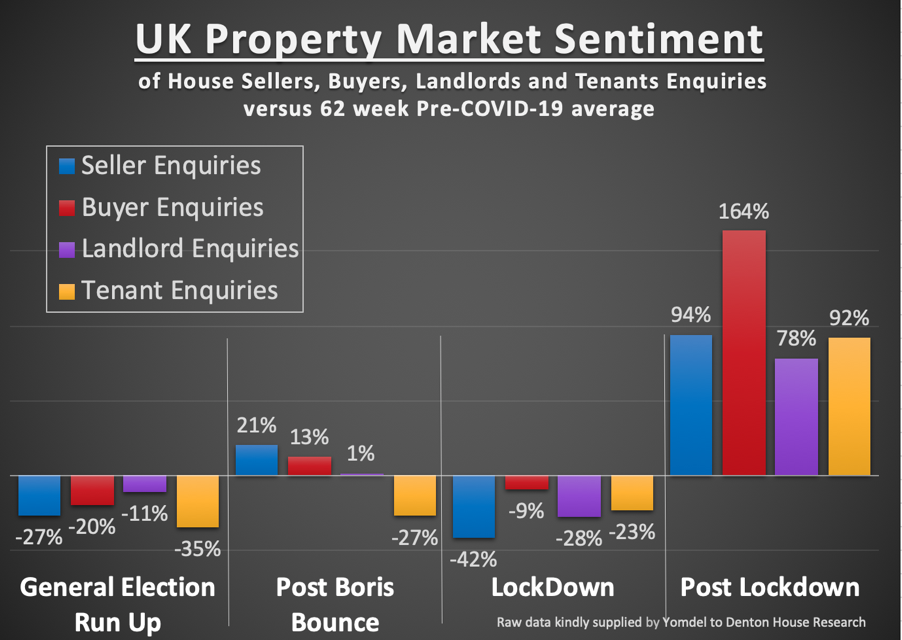

Data from Yomdel, the live chat and telephone answering service for a quarter of UK estate and letting agents, is able to track objective and more current information from across the UK on what is really happening. Each week, they are dealing with thousands of enquiries including:

- Seller enquiries (e. house sellers looking to put their property on the market)

- Buyer enquiries (e. people looking to view a property on the market with the intention of buying it)

- Landlords enquiries (e. landlords looking for tenants for their rental property)

- Tenant enquiries (e. people looking to view a property on the market with the intention of renting it)

They have created a rolling weekly average of those enquiries for the whole of the UK for the 62 weeks before the country went into lockdown. Then they compared that 62 week average with specific time frames, namely the 10 weeks of the run up to the General Election, the 8 weeks of Post Boris Bounce in January and February 2020, the weeks of lockdown in March, April and early May and then finally, from mid-May, the post lockdown.

You might ask why tracking estate and letting agency enquiries is so important?

Enquiries in letting and estate agencies are the beating heart of the property market – they are the ECG machine of the estate and letting agency. Of course, house price data has its place and is lauded by the national press as the bellwether of the property market, yet it takes 6 to 9 months for the effects of what is happening today to show in those house price indexes, whilst these enquiries are what is happening now.

Have a look at the data in the graph and table, it can be seen in the 8 weeks up to the General Election, every metric was down. Next, the post Boris Bounce saw house seller and house buyer leads increase yet note how low tenant enquiries were (hardly any change from the run up to the election), everything dipped during lockdown as expected, yet look at all the metrics post lockdown … amazing! (e.g. if a number in the graph/table below is say -25%, that means its 25% below the rolling 62 week average, yet if it were +20%, then that would mean it would be 20% more than the rolling 62 week average)

The numbers speak for themselves!

So, what is happening in the Rotherham property market? Well, there is plenty of activity in the Rotherham property market, yet that doesn’t mean everything is back to normal. Enquiries are an important metric, yet another way to judge the health of the property market is to look at the number of property transactions (i.e. people moving).

Now the Land Registry data isn’t quite as exhilarating, yet it is less volatile. Nationally, it shows that property transactions were at their lowest level since its records began in April 2005. The seasonally adjusted estimate of UK residential property transactions in April and May 2020 was 90,210, 53.4% lower than the 193,500 transactions of May & April 2019. Again though, this was because of the restrictions on moving during Covid-19. The stats for Rotherham are still to be released, yet rest assured I will share them in due course.

Looking again at what is happening now, when I look at the number of properties for sale…

325 Rotherham properties have come onto the property market in the last 30 days alone, and of those, 90 are already sold subject to contract

So, what of the future of the post-lockdown Rotherham housing market? While a stern recession seems almost guaranteed, a housing market crash is not. Many newspapers are predicting property values to fall in 2020, then rise reticently from the ashes in 2021. The fact is, nobody knows. The property market is driven a lot by sentiment. Buying a home is not like buying stocks and shares – it’s a home to live in … and those Rotherham landlords who are looking for an investment opportunity, often let their heart rule the head (again sentiment) when investing in property.

Property always has, and always will be, a long-term investment. Many of you Rotherham people reading this, especially potential Rotherham first time buyers, have been putting off buying your first home because of Brexit, now its Covid-19, and in a few years, it will be something else. There will always be ‘something else’… and you could get to your 50’s and 60’s, still renting, waiting for the ‘next thing’ to pass before you buy … and end up buying nothing.

Nobody knows what the months or years ahead will bring … yet what I do know is, people will always need a place to live. Please let me know your thoughts in the comments. Tell us what your experiences are as a Rotherham landlord or homeowner, tenant or buyer so we can all learn from each other.

Jun 20, 2020

Isn’t it funny that nobody boasts they are a buy to let landlord anymore? Roll the clock back to the early millennium and you couldn’t go to the local golf club or shop at a Waitrose without someone dropping buy to let into the conversation as easily and as often as the weather.

Yet now, Rotherham buy to let landlords have almost pariah status, as they place a brown paper bag over their head when they enter a letting agency, lest they be recognised as such. They can easily be recognised though, as the average age of a UK tenant is 32 years old, whilst the average age of a UK landlord is between 40 and 61 years old.

Joking aside, if it wasn’t for buy to let landlords – Rotherham and the UK would be in a rather difficult position when it comes to housing our local people. Many people believe that if you take buy to let landlords out of the loop of the UK property network, then it would be the land of milk and honey for first-time buyers priced out of the market. Those Rotherham landlords provide those Rotherham tenants with a mixture of homes to live in and using market forces, ensure the right number of Rotherham homes are available. In fact, the stats show that…

Rotherham buy to let landlords provide 5,416 Rotherham homes for 12,877 Rotherham tenants

Yet the retort from many tenant organisations would be that Rotherham landlords are wealthy middle -lass people, voraciously exploiting the failing Rotherham property market for their profit and greed. Of course, the demographic of an average Rotherham landlord is they tend to come from more fortunate backgrounds, with 3 in 4 of Rotherham landlords aged between their late 40’s to late 60’s and 4 in 10 having a degree level qualification.

It also wouldn’t surprise anyone to learn that those who invest in buy to let Rotherham property are likely to be better off than those who have not yet been able to buy a home. Yet, that is the nature of the country we live in and it’s a consequence of a competitive free market economy (the alternative didn’t go too well in Soviet bloc). Indeed, asserting that the buy to let landlords represent a transfer of wealth and money from tenants to landlords is like saying that the pub represents a transfer of wealth from drinkers to the pub landlord.

Don’t get me wrong, the tax loopholes for landlords up until 3 or 4 years ago were a little ‘too’ generous, still these were closed by the Tory’s themselves. However, should the Government try to place even more burden on landlords like some are suggesting, forcing them to sell, I am certain some Rotherham first time buyers would find it cheaper to buy their first Rotherham home. This is because they wouldn’t be in competition with Rotherham landlords to buy the starter homes both types of buyers crave, meaning house prices would drop (simple economics would dictate that).

Yet, if the supply of Rotherham privately rented homes contracted at a greater rate (because landlords were selling up) than demand, this would make renting more expensive (again simple economics) for the vast majority of Rotherham tenants who were still renting a Rotherham home. Irrespective of whether property values dropped, it might take years for a tenant to save for a deposit, whilst for the rental properties the landlords wants to sell, the tenants only need to be given two months’ notice to leave so the property can be put on the market.

One might ask why don’t the local authorities build more council houses?

Well, Government funding has been tight because of the Credit Crunch deficit since 2009 and going forward because of the current situation with Covid-19, it will get even worse. In fact, of the 617,230 new homes built in the country over the last 4 years, only 8,270 or 1.33% were built by local authorities, meaning only just over 1 in 100 of all new properties built in the last 4 years were built by the local authorities.

This is important as the number of people in rented property has been growing over the last 20 years. In fact, when you look at all the tenants in council and private rented accommodation locally…

34.6% of Rotherham people live in a rented property

Interestingly, the demographic of a council house tenant is totally different to that of a tenant in a private rented home. The average age of a council house tenant is 52 years old (compared to 32 years for a private rented tenant), so it appears the older generation have the upper hand on council houses. So again, who exactly is going to house the people of Rotherham, especially the younger generation that can’t afford to buy?

Local authorities haven’t got the money, housing associations get their money from central Government, so the only other source of housing is private landlords. The problem existed before private landlords filled the gap. No doubt many Rotherham landlords have certainly gained from the problem, especially between 2000 and 2007, yet at the same time, they have helped home millions of people.

Consequently, are Rotherham landlords greedy and selfish? For most law abiding Rotherham landlords, who look after their tenants and their properties really well, nothing could be further from the truth… and yes they have made some money – yet if you take into account property maintenance, mortgage finance, taxation, agent fees, surveys and inspections – it’s really not the gold mine many think it is.

Not until all the political parties stop using the housing issue as a political football will this issue be sorted. For example, it makes sense to allow mass building in the South East, again driving up supply and making property more affordable, yet that would wind up the Tory voting home county heartlands. It’s a shame because we do have the room to build more homes, in fact…

Only 1.2% of the country has houses built on it

The country needs a massive root and branch change to sort things out, yet I have grave misgivings that any politician has the stomach or the political resolve to do anything about it.

If Covid-19 does affect the confidence in the property market that will in fact be good news for Rotherham landlords, as long as the Government doesn’t put its big ‘size 9’s in to the rental market by taking even more money out landlords pockets.

Historically, ambiguity in the property market typically results in an expansion in activity in the private rental market. Prospective home movers will rent in between selling their home and buying the next one, while budding first time buyers typically postpone their purchase and stay in the private rental market for marginally longer … which all increases demand for rental property.

Feb 5, 2020

Rotherham Property Market

… the Rollercoaster of the last Decade

Ah the 2010’s, the tens, the teens – I am not sure what we are supposed to call the decade that has just gone. No matter what it was called, the last decade was a tough one, so does it really matter that we never really got around to giving it a name? Some might say, whatever one calls it, coming to an end is the most fundamental job any teen (and I refer to all humans) could possibly do!

The last two decades have certainly been tumultuous. At least for this decade we have just started we can say, in a few decades time, things like “That style is so ’20s” and fellow humans will essentially know what you are talking about. If you come of age in this decade, you will be a ’20s child and we will discuss ’20s politics and ’20s style and all the things that hadn’t been created on the 31st December 2019; the time that two nameless decades ended and how finally there was something everyone in the UK could agree on: the name of the decade. Hey – it’s a start!

So, what has happened to the local Rotherham property market in the last nameless decade?

The average Rotherham property has risen in

value from £135,700 to £159,700 in the last 10 years

… meaning each Rotherham homeowner has seen a profit of £46.15 per week for those last ten years. Rolling the clock back to the start of the last decade January 2010, and the economy (and housing market) were recovering from the Credit Crunch and the worldwide financial crisis. A decade on and things feel a little different. If you bought a Rotherham home over the past 10 years, things have certainly changed.

Rotherham property values rose 17.7% on

average over the last decade

yet taking inflation into account, they fell in real terms by 15.4 per cent.

Compare that to a 42.5% rise in the ‘80s, a 13.2% drop in the ‘90s and rise of 62.8% in the 2000s in real terms. So, in real terms after inflation, there has been a decrease in house prices in Rotherham in the past decade making homes today more affordable than a decade ago.

On average, 1.12 million homes were sold each year last decade, although that was 26.4% less than the decade before (the noughties) when an average of 1.52 million properties were sold annually.

So, what are the underlying issues in the Rotherham (and wider UK) property market when, in real terms, property is essentially cheaper than a decade ago? Whilst the newspapers tell us first time buyers can’t get on the housing ladder and the housing market is in gridlock – what is the problem? Well I am a firm believer in the adage ‘bad news sells newspapers’ because the truth is something completely different as 32.7% of homes last year were bought by first time buyers compared with only 22.8% in 2009.

Yet, there are still issues; mainly a persistent lack of not building enough new homes which curtails the supply and choice of property; but stagnated wages, stiffer mortgage rules and homeowners not moving as much as previous generations are all contributing to the problem. In the UK, the number of homeowners who moved in 2019 was around 14% higher than in 2009, yet this was still just under 50% lower than the average for the noughties. It’s all up and down like a rollercoaster!

My thoughts for the future are based primarily on what will happen to interest rates. Throughout the last decade, the Bank of England base rate was 0.5% at the start and was cut to 0.25% in the Summer of 2016. Even with the increase to its current level of 0.75% in the Summer of 2019, it has made borrowing money on a mortgage very cheap indeed. Nonetheless, bank/mortgage rates will rise again and I am concerned about the effect upon the housing market. Now it won’t be as bad as previous times when mortgage rates went up in the 1970’s and 1980’s (with mass repossession) because the tougher mortgage rules introduced in April 2014 will have ensured borrowers were stress tested on their affordability if interest rates shot up. Most borrowers have been stress tested on their affordability to mortgage rates of up to 6% – 6.5%, which would obviously squeeze household disposable incomes yet stop people losing their homes due to repossession. Whilst I am not giving advice, just personal opinion, if you are one of the 29.3% of homeowners who isn’t on a fixed rate – maybe you should seriously consider doing so?

The 2020’s will be an interesting decade – and if you want to be kept up to date with what is happening in the Rotherham (and wider UK) housing market – follow me and this blog to read similar articles to this one.

Feb 5, 2020

37,616 People Live in Rented Accommodation in Rotherham

That number surprised you didn’t it? With the General Election done, I thought it time to reflect on renting in the manifestos and party-political broadcasts and ask why?

As the best way to tell the future is to look at to the past, so we decided to look at the number of people who rented a century ago (1920’s), and surprisingly 76% of people rented their home in the UK (as renting then was considered the norm). Yet in the latter part of the 1920’s, builders of the suburban housing estates with their bay fronted semis started to sell the dream of home ownership to smart renters.

Up until the mid 1920’s, the mortgage had been seen as a millstone around your neck. Now, due to some clever marketing by those same builders, it was started to be seen as a shrewd long-term investment to buy your own home with a mortgage. It fuelled the ambitions and goals of the up and coming well-to-do working class who reclassed themselves as lower-middle class. Meanwhile, the Government encouraged (through tax breaks) people to save in Building Societies whom in turn lent the money to these up and coming new homeowners thorough mortgages.

Roll the clock forward to the decade of the young Elvis, Chuck Berry, and Bill Haley (1950’s) and still 72% of Brits rented their home. Homeownership had boomed in the preceding 30 years, yet so had council house building. Then, as we entered the 1960’s and 1970’s homeownership started to grow at a higher rate than council housing.

The rate of homeownership started to drop substantially after the mid 1990’s, and now we roll the clock forward to today, there is no stigma at all to renting … everyone is doing it. In fact, of the…

108,754 residents of Rotherham, 37,616 of you rent your house

from either the council, housing association or private landlords – meaning 34.6% of Rotherham people are tenants. Yet read the Daily Mail, and you would think the idea of homeownership is deeply embedded in the British soul?

69,269 Rotherham people live in an owner-occupied property

(or 63.7%)

So, we have a paradox – homeowners or renters? The reason I suggest this, is, I noticed on the run up to the Election that housing was used at the General Election as way to get votes. This is nothing new, as all parties have always used housing to get votes, although previously it was about which party would build more council houses in the 1950’s through to council Right to Buy with Thatcher (and everyone since) -running election campaigns promising everybody their own home in one way or another.

Yet, did you notice at this election something changed? The parties weren’t talking so much about increasing homeownership but about protecting the tenant. It seems the link between homeownership as the main goal of British life is starting to changeas we are slowly turning to a more European way of living. Renting is here to stay in Rotherham and incrementally growing year on year. You see, in Britain there is no property tax based on ownership, which many other western countries have. Instead Council Tax is paid by the occupier of the home (meaning the tenant pays – not necessarily the owner).

Both parties wanted to end no-fault evictions (which is a good thing), yet Labour went further and mentioned rent controls in their manifesto. As I have mentioned before in other articles on the Rotherham property market, rents since 2008 (even in central London) have not kept up with inflation – so again was that another headline to grab votes/election bribe? The fact is the majority of new British households formed since the Millennium can now expect to rent from a private landlord for life – therefore the parties focus on this important demographic.

Yet even with the new mortgage relief tax rules for landlords and the 200+ of legislation that govern the private rental sector, buy to let is still a viable investment option for most investors in Rotherham. There has never been a better time to purchase buy to let property in Rotherham … but buy wisely. Gone are the days when you would make a profit on anything with four walls and a roof. Most importantly do your homework, take advice and consider your options.

Nov 5, 2019

- Across the UK, it is estimated in the region of £500 million is spent celebrating Bonfire Night and the foiling of the gunpowder plot back in 1605. Around half the population is set to don woolly hats and scarves to attend organised events.

- To date in 2019, every weekday on average twice this amount of money is spent on property purchases.

- It would take just three days’ of property sales across London and the South East to hit this figure, compared to over 20 days’ in the North East and Wales.

- Toasted marshmallows are considered the most popular Bonfire Night Snack, followed by Toffee Apples and Bonfire Toffee. Fingers crossed the rain stays away.

- Across the UK, it is estimated in the region of £500 million is spent celebrating Bonfire Night and the foiling of the gunpowder plot back in 1605. Around half the population is set to don woolly hats and scarves to attend organised events.

- To date in 2019, every weekday on average twice this amount of money is spent on property purchases.

- It would take just three days’ of property sales across London and the South East to hit this figure, compared to over 20 days’ in the North East and Wales.

- Toasted marshmallows are considered the most popular Bonfire Night Snack, followed by Toffee Apples and Bonfire Toffee. Fingers crossed the rain stays away.

- Across the UK, it is estimated in the region of £500 million is spent celebrating Bonfire Night and the foiling of the gunpowder plot back in 1605. Around half the population is set to don woolly hats and scarves to attend organised events.

- To date in 2019, every weekday on average twice this amount of money is spent on property purchases.

- It would take just three days’ of property sales across London and the South East to hit this figure, compared to over 20 days’ in the North East and Wales.

- Toasted marshmallows are considered the most popular Bonfire Night Snack, followed by Toffee Apples and Bonfire Toffee. Fingers crossed the rain stays away.

- Across the UK, it is estimated in the region of £500 million is spent celebrating Bonfire Night and the foiling of the gunpowder plot back in 1605. Around half the population is set to don woolly hats and scarves to attend organised events.

- To date in 2019, every weekday on average twice this amount of money is spent on property purchases.

- It would take just three days’ of property sales across London and the South East to hit this figure, compared to over 20 days’ in the North East and Wales.

- Toasted marshmallows are considered the most popular Bonfire Night Snack, followed by Toffee Apples and Bonfire Toffee. Fingers crossed the rain stays away.

- Across the UK, it is estimated in the region of £500 million is spent celebrating Bonfire Night and the foiling of the gunpowder plot back in 1605. Around half the population is set to don woolly hats and scarves to attend organised events.

- To date in 2019, every weekday on average twice this amount of money is spent on property purchases.

- It would take just three days’ of property sales across London and the South East to hit this figure, compared to over 20 days’ in the North East and Wales.

- Toasted marshmallows are considered the most popular Bonfire Night Snack, followed by Toffee Apples and Bonfire Toffee. Fingers crossed the rain stays away.

Oct 25, 2018

It is feeling very autumnal across Rotherham. Alongside this, some interesting statistics have come to light on about our local property market. I think they will be thought provoking to both homeowners and buy-to-let landlords.

One headline that has stuck out is this: over the last 12 months 2,196 households have changed hands in Rotherham. This is slightly below the average for the last 10 years, which is numbered at 2,216 households per year.

Yet, for the purpose of this article, I want to discuss the pricing of the current crop of Rotherham’s property sellers. What interests me is the price people are asking for their homes compared with the prices that they are actually achieving (or not, as the case may be!) It is so important for all property owners to know the real story, so they can judge for themselves where they stand in the current housing market. This will enable you to make suitable and informed decisions. I always aim to give the real answers, not simply the answers what people want to hear.

The problem with over-valuing a house

The national average of homes selling at or above the asking price currently stands at around 10%, so around 90% go below the asking price – but by how much? Well according to Rightmove, in the Rotherham area, the average difference between the ‘FINAL asking price’ to the price agreed is 3.5% … yet note I highlighted the word FINAL in the last statement.

You see some Estate Agents will deliberately over inflate the suggested initial asking price to the house seller, because it gives them a greater chance to secure the property on that agent’s books, as opposed to a competitor. This practice is called overvaluing. Now of course, each homeowner wants to get the most for their property, it is quite often their biggest asset – yet some agents know this and prey on those house sellers.

You might ask, what is the issue with that?

Well, you only get one chance of hitting the market as a new property. Everyone has access to the internet, Rightmove and Zoopla etc, and your potential buyers will know the market like the back of their hand. If you have a 3 bed semi that is on the market for a 3 bed detached house price… those buyers will ignore you. Your Rotherham property sticks on the market, potential buyers will keep seeing your Rotherham property on Rightmove each week, then start to think there is something wrong with it and dismiss it even further, until you, as the house seller have to reduce the asking price so much (to make it appear inexpensive) to sell it.

According to our own research, the average house buyer only views between 4 and 5 houses before buying – so don’t assume viewers will come round your optimistically priced (i.e. overvalued) property, thinking they will knock you down – no quite the opposite!

So how widespread is overvaluing in Rotherham?

The results might surprise you… 42.0% of properties in Rotherham, currently on the market, have reduced their asking price by an average reduction of 6.4% (which equates to £10,500 each)

So, all I ask is this.. be realistic and you will sell at a decent price to a decent buyer. First time – every time – enabling you to move on to the next chapter of your life.

If you need my advice I am happy to help. Please get in touch here.

Page 2 of 25«12345...1020...»Last »