Aug 10, 2016

I had a homeowner from Whiston email me the other day. She said she had been following this blog for a while and wanted to pick my brain on when is the best time of the year to sell a property.

Trying to calculate the best time to put your Rotherham property on the market can often seem something akin to witchcraft and, whilst I would agree that there are particular times of the year that can prove more productive than others, there are plenty of factors that need to be taken into consideration.

Even if you are putting your property on the market, you don’t know how long it will take to find a buyer – no crystal ball to help with that one. At the moment, the latest set of figures for all 16 estate agents in Rotherham, show the average length of time it takes to find a buyer for any Rotherham property is as follows:

Detached: 227 days

Semi: 223 days

Terraced: 191 days

Flat: 413 days

Overall average: 231 days

If we roll the clock back to January 2016, the overall average time it took to find a buyer (again using data from all of the 16 Rotherham Estate Agents) was 265 days.

So, on the face of it, things have improved between winter and summer over the last year.

In fact, when I looked at the data going back to 2009, and every Spring since then, the average length of time it takes to sell a property drops between January and the Summer months. For example:

Winter 2009 – 242 days Summer 2009 – 236 days

and in more recent years:

Winter 2013 – 322 days Summer 2013 – 303 days

Winter 2014 – 300 days Summer 2014 – 280 days

Winter 2015 – 271 days Summer 2015 – 239 days

You can see this information in the bar chart below:

Coming back to the present, even if you placed your property on the market today in Rotherham, if it takes you on average thirty three weeks to find a buyer you can also expect solicitors and the chain to take an additional eight and twelve weeks after that before you move.

Therefore, it comes down to personal choice as to when you place your property on the market.

Children can often impact the decision. On one side you might delay putting that for sale board in your front garden so you can move in the summer school holidays, but on the other side, you might want to move sooner to be in the catchment area of a preferred school, in plenty of time for the next academic year.

There are times of the year when it’s better to sell, and times when waiting a little longer can pay off in the long run.

In a nutshell, I would say this is the way of the seasons…

Spring: Customarily the number of house-buyers blossoms after the winter

Summer: Sellers may miss out on house-buyers being on holiday

Autumn: The enthusiasm for buying homes returns

Winter: Interest diminishes as festive period looms

What this means to buyers and landlord investors is that they can often pick up a bargain in later months of the year as there is less competition from owner occupiers. So, whilst there are better months to achieve a quicker sale, the only piece of advice I can give to every home owner and landlord in Rotherham is to do the right thing for yourself. Do your homework and buy (and sell) with both your head as well as your heart.

For more thoughts on the Rotherham Property Market you can visit our Facebook page or follow us on Twitter.

Aug 3, 2016

Call me old fashioned, but I do like the terraced house. In fact, I have done some research that I hope you will find of interest my Rotherham Property Blog reading friends!

In architectural terms, a terraced or townhouse is a style of housing, in use since the late 1600s in the UK, where a row of symmetrical / identical houses share their side walls. The first terraced houses were actually built by a French man, Monsieur Barbon around St. Paul’s Cathedral within the rebuilding process after the Great Fire of London in 1666. Interestingly, it was the French that invented the terraced house around 1610-15 in the Le Marais district of Paris with its planned squares and properties with identical facades. However, it was the 1730s in the UK, that the terraced/townhouse came into its own in London. The impressive Royal Crescent in Bath was built at a similar time.

However, we are in Rotherham not Bath.

The majority of our Rotherham terraced houses were built in the Victorian era. Built on the back of the Industrial Revolution, with people flooding into the towns and cities for work in Victorian times, the terraced house offered decent livable accommodation away from the slums. An interesting fact is that the majority of Victorian Rotherham terraced houses are based on standard design of a ‘posh’ front room, a back room (where the family lived day to day) and scullery off that. Off the scullery is a door to a rear yard, whilst upstairs there is usually three bedrooms (the third straight off the second). Interestingly, the law was changed in 1875 with the Public Health Act and each house had to have 108ft of livable space per main room, running water, it’s own outside toilet and rear access to allow the toilet waste to be collected (they didn’t have public sewers in those days in Rotherham – well not at least where these ‘workers’ terraced houses were built).

It was not until the 1960s and 70s when inside toilets and bathrooms were installed (often in that third bedroom or an extension off the scullery). Gas central heating was added in the 1980s and replacement uPVC double glazing has been added ever since.

Looking at the make up of all the properties in Rotherham, some very interesting numbers appear. Of the 47,601 properties in Rotherham:

- 7,916 are Detached properties (16.6%)

- 23,312 are Semi Detached properties (48.6%)

- 9,303 are Terraced / Town House properties (19.5%)

- 7,246 are Apartment / Flats (15.2%)

And quite noteworthy, there are 4 mobile homes, representing 0.01% of all property in Rotherham.

When it comes to values, the average price paid for a Rotherham terraced house in 1995 was £25,980 and the latest set of figures released by the land Registry states that today that figure stands at £71,410, a rise of 175% – that’s not bad at all is it. But then a lot of buy-to-let landlords and first time buyers I speak to think the Victorian terraced house is expensive to maintain.

However, I recently read a report from English Heritage that stated maintaining a typical Victorian terraced house over thirty years is around 60% cheaper than building and maintaining a modern house – quite fascinating don’t you think?!

Don’t dismiss the humble terraced house – especially in Rotherham!

Connect with us on Facebook and Twitter for further articles, news updates and discussion

Jul 27, 2016

I was having an interesting chat with a Rotherham buy-to-let landlord the other day when the subject of size of households came up in conversation.

For those of you who read my Brexit article published on the morning after the referendum, one of the reasons on why I thought the Rotherham property market would be OK in the medium to long term, was the fact that the size of households in the 21st Century was getting smaller – which would create demand for Rotherham property and therefore keep property prices from dropping.

Looking at the stats going back to the early 1960s, when the average number of people in a home was exactly 3, it has steadily dropped by a fifth to today’s figure of 2.4 people per household. Doesn’t sound a lot, but if the population remained at the same level for the next 50 years and we had the same 20% drop in household size, the UK would need to build an additional 5.28 million properties (or 105,769 per year).

When you consider the country is only building 139,800 properties a year it doesn’t leave much room for people living longer and immigration to the UK.

Looking closer to home, in the Rotherham Metropolitan Borough Council area, the average number of occupants per household is 2.4 people.

When we look at the current picture nationally and split it down into tenure types (i.e. owned, council houses and private renting) a fascinating picture appears.

The vast majority of homeowners who don’t have a mortgage are occupied by one or two people (81% in fact), although this can be explained as residents being older, with some members of the family having moved out, or a pensioner living alone. People living on their own are more likely to live in a Council house (43%) and the largest households (those with 4 or more people living in them) are homeowners with a mortgage – but again, that can be explained as homeowners with families tend to need a mortgage to buy. What surprised me was the even spread of private rented households and how that sector of population is so evenly spread across the occupant range – in fact that sector is the closest to the national average, even though they only represent a sixth of the population.

When we look at the Rotherham Metropolitan Borough Council figures for all tenures (Owned, Council and Private Rented) a slightly different picture appears…

| 1 person households | 2 person households | 3 person households | 4 person households | 5+ person households |

| 28.54% | 35.69% | 16.46% | 13.15% | 6.16% |

But it gets even more interesting when we focus on just private rental properties in Rotherham, as it is the rental market in Rotherham that really fascinates me. When I analysed those Rotherham private rental household composition figures, a slightly different picture appears. Of the 11,153 Private rental properties in the Rotherham Metropolitan Borough Council area,

- 31.4% of Private Rental Properties are 1 person Households

- 32.0% of Private Rental Properties are 2 person Households

- 17.7% of Private Rental Properties are 3 person Households

- 11.1% of Private Rental Properties are 4 person Households

- 7.5% of Private Rental Properties are 5+ person Households

As you can see, Rotherham is not too dissimilar from the national picture but there is story to tell. If you are considering future buy to let purchases in the coming 12 to 18 months, I would seriously consider looking at 1 or 2 bed apartments/houses. They have to be in the right part of Rotherham and priced realistically, but they will always let and when you need to sell, irrespective of market conditions at the time, they should be the target of buyers.

Even with the numbers stated, there are simply not enough 1 or 2 bed apartments/houses to meet the demand.

Connect with us on Facebook and Twitter for further articles, news updates and discussion.

Jul 20, 2016

Rotherham faces a predicament. The population is growing and the provision of new housing isn’t keeping up.

With the average age of a Rotherham person now 40.2 years (compared to the Yorkshire and Humber average of 39.4 years old – the same as the national average age), the population of Rotherham is growing. This is due to an amalgamation of longer life expectancy, a fairly high birth rate (compared to previous decades) and high net immigration, all of which contribute to housing shortages and burgeoning house prices.

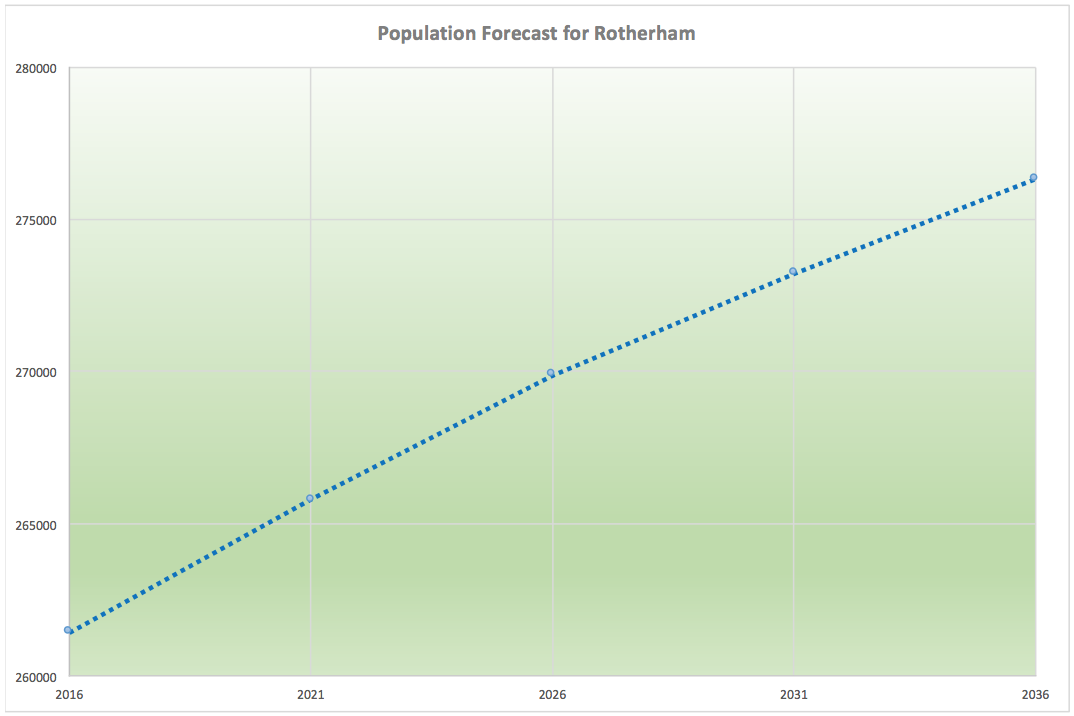

My colleagues and I work closely with Durham University and they have kindly produced some statistics specifically for the Rotherham Metropolitan Borough Council area. Known as the UK’s leading authority for such statistics, their population projections make some very interesting reading…

For the Rotherham Metropolitan Borough Council area these are the statistics and future forecasts:

2016 population 261,411

2021 population 265,782

2026 population 269,895

2031 population 273,214

2036 population 276,334

The normal ratio of people to property is 2 to 1 in the UK, which therefore means…

We need just over 7,000 additional new properties to be built in the Rotherham Metropolitan Borough Council area over the next 20 years.

Whilst focusing on population growth does not tackle the housing crisis in the short term in Rotherham, it has a fundamental role to play in long-term housing development and strategy in the town. The rise of Rotherham property values over the last six years since the credit crunch are primarily a result of a lack of properties coming onto the market, a lack of new properties being built in the town and rising demand (especially from landlords looking to buy property to rent them out to the growing number of people wanting to live in Rotherham but can’t buy or rent from the Council).

Although many are talking about the need to improve supply (i.e. the building of new properties), the issue of accumulative demand from population growth is often overlooked. Nationally, the proportion of 25-34 year olds who own their own home has dropped dramatically from 66.7% in 1987 to 43.8% in 2014, whilst 78.2% of over 65s own their own home. Longer life expectancies mean houses remain in the same hands for longer.

The swift population growth over the last thirty years provides more competition for the young than for mature population. It might surprise some people that 98% of all the land in the UK is either industrial, commercial or agricultural, with only two percent being used for housing. One could propose expanding supply to meet a expanding population by building on green belt – this is a suggestion that most politicians haven’t got the stomach to tackle, especially in the Tory strongholds in the south, where the demand is the greatest. People mention brownfield sites, but recent research suggests there aren’t as many sites to build on, especially in Rotherham, that could accommodate 7,000 properties in the next 20 years.

In the short to medium term, demand for a roof over of one’s head will continue to grow in Rotherham (and the country as a whole). In the short term, that demand can only be met from the private rental sector (which is good news for homeowners and landlords alike as that keeps house prices higher).

In the long term though, local and national Government and the UK population as a whole, need to realise these additional millions of people over the next 20 years need to live somewhere. Only once this issue starts to get addressed, in terms of extra properties being built in a sustainable and environmentally friendly way, can we all help create a socially ecological prosperous future for everyone.

For more thoughts and insights on the Rotherham Property Market you can visit our Facebook page or follow us on Twitter.

Jul 13, 2016

Rotherham house prices since the Millennium have risen by 113.65%, whilst average salaries in Rotherham have only grown by 51.27% over the same time frame. This has served to push homeownership further out of reach for many Rotherham people as they have to battle against raising considerable deposits and meet sterner lending criteria, as a result of new mortgage regulations introduced in 2014/5. The private rental market in Rotherham has grown throughout the last twenty years with buy-to-let investors purchasing a high proportion of newly built residential properties that were built and designed for the owner occupier sales markets. For example, in the Rotherham Constituency, roll the clock back 20 years and there were 32,524 properties in the Constituency, whilst the most recent set of figures show there are 37,358 properties – a growth of 4,834 properties.

However, anecdotal evidence suggests that a large number of those 4,834 were bought by Rotherham buy-to-let landlords, as over the same 20-year time frame, the number of rental properties has grown from 2,011 to 4,561 in the Constituency – a rise of 2,550 properties.

Nevertheless, some say this historic growth of the Rotherham rental market might start to change with the new tax rules for landlords introduced by Mr. Osborne over the last seven or eight months. Yet the numbers tell another story. Across the board, mortgage borrowing climbed to a 9 year zenith in March this year as the British property markets traditional Easter rush corresponded with landlords hurrying to beat George Osborne’s new stamp duty changes – buy-to-let landlords borrowed £7.1bn in March 2016 (the latest set of figures released) which was 163% up on the £2.7bn borrowed in the previous March.

You see, from my point of view, I don’t think things will get worse in the buy-to-let market in Rotherham and these are the reasons why I believe that:

Firstly, what else are Rotherham landlords going to invest in if it isn’t property – the stock market? Since the Millennium, the stock market has risen by an unimpressive total of 5.54%, quite different to the 113.65% rise in Rotherham property prices?

Secondly, its true the 3% stamp duty is the first blow on top of a number of other tax changes to be phased in between 2017 and 2021, such as landlords facing a constraint in their ability to offset mortgage interest and, if sizeable numbers of landlords do take the decision to sell their portfolios, this will lead to a substantial amount of second hand properties being put up for sale. Yet that might not be a bad thing, as I have mentioned in previous articles there is a serous shortage of properties to buy at the moment in Rotherham: the stock of property for sale being at a six year all time low.

.. Thirdly, if there are fewer rental properties in Rotherham, as supply drops and demand remains the same (although ask any letting agent in Rotherham and they will say demand is constantly rising) this will create a squeeze in the Rotherham rental market and as a result rents will rise. In fact, I predict even if landlords don’t sell up, Rotherham rents will rise as Rotherham landlords seek to compensate for increased costs, which means more landlords will be attracted back.

Connect with us on Facebook and Twitter for further articles, news updates and discussion

Jul 6, 2016

With Rotherham youngsters not able to buy their own property, my research would suggests the progressively important role the private rented sector has been playing in housing people in need of a roof over their head.

This is especially apparent at a time of increasing affordability problems for first time buyers and growing difficulties faced by social housing providers (local authorities and housing associations) in their ability to secure funding from Westminster and then compete against the likes of the Boris’s and David Wilson’s of this world to buy highly priced building land.

Renting isn’t like it was in the 1960’s and 70’s, where tenants couldn’t wait to leave their rack-rent landlords, charging sky-high rents for properties with Second World War woodchip wallpaper, no central heating and drafty windows. Since 1997 with the introduction of buy to let mortgages and a new breed of Rotherham landlord, the private rented sector in Rotherham has offered increasingly high quality accommodation for younger Rotherham households.

So whilst I knew in my own mind that the type and class of tenant has improved over the last 20 years, I had nothing to back that up … until now. According to some detailed statistics from Durham University just released, for the Rotherham Metropolitan Borough Council area, the current situation regarding social status of tenants shows some very interesting points. Using the well known Demographic ABC1 grade classifications which refers to the social grade definitions (which describe, measure and classify people of different social grade and income and earnings levels, for market research, social commentary, lifestyle statistics, and statistical research and analysis) this is what I found out.

Of the 17,044 tenants who live in a private rented property in the Rotherham Metropolitan Borough Council area, 8.30% (or 1,415) of those tenants are classified in the AB category (AB Category being Higher and intermediate managerial / administrative / professional occupations), compared to 16.97% owner occupiers who own their property without a mortgage or 2.40% who rent their property from the local authority. Fascinating don’t you think?

Looking at the C1’s (C1’s being the Supervisory, clerical and junior managerial / administrative / professional occupations), of the already mentioned 17,044 tenants in the area, an impressive 4,213 of them are considered to be in the C1 category (or 24.72%). Again, when compared with the owner occupiers who own their property without a mortgage, that figure stands at 25.33% and 14.25% who rent their property from the local authority. So, if we use the conventional measurements recorded by the white-collar “ABC1” i.e. middle class ….

This means 33.02% of tenants are considered middle class in Rotherham

I could go through all of the social categories through to ‘E’, but I humbly don’t want to bore you with too many numbers. The fact is that private tenants are moving up the social ladder and whilst back in the 1960’s and 70’s, the private rented sector in Rotherham (and the rest of the UK) has customarily been viewed as a temporary tenure for 20 somethings before they bought a property, the increase in renting in Rotherham, which I have talked about many times in the Rotherham Property Market Blog may be a reflection of increasing difficulty for this group in accessing other tenures, but may also be a reflection that people nowadays choose to rent long term instead?

Rotherham Landlords need to be aware that tenants now demand more from their properties, the agent and their landlord and whilst affordability for first-time buyers and tighter controls on lending may mean that potential first-time buyers are in the private rented sector for longer, they will still pay ‘top dollar’ rent for a ‘top dollar’ property.

For more articles, news, discussions and updates on the property market – Like us on Facebook and Follow us on Twitter