Dec 20, 2016

While Brexit has not yet had a sizeable impact on the Rotherham housing market, my analysis is pointing to the fact that the economy still remains uncertain and Rotherham property price growth is likely to be more subdued in 2017. Let me explain why this isn’t a bad thing.

Since the summer, apart from a little wobble of uncertainty a few weeks after the EU Referendum vote, property values (and the economy), on the whole has outperformed what most people were predicting.

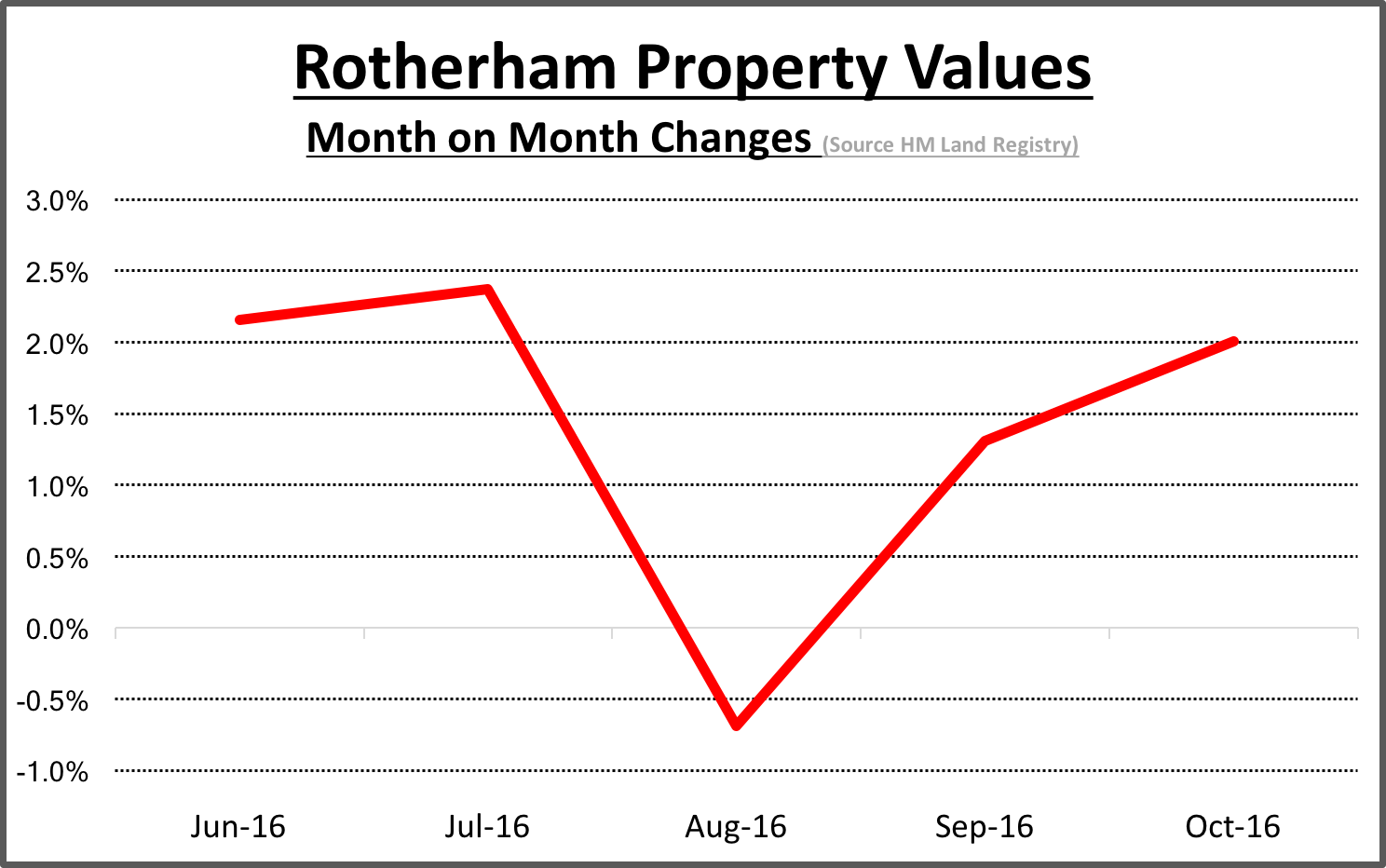

In fact, when I looked at the property prices for our area, these were the results…

October 2016: drop of 2.01%

September 2016: rise of 1.31%

August 2016: drop of 0.69%

July 2016: rise of 2.37%

June 2016: rise of 2.16%

The UK property market continues to perform robustly (because we can’t just look at Rotherham as if in its own little bubble):

Annual price growth is set to end 2016 at 6.91% and most of the Yorkshire and Humber region property market will end around 4.21%.

Talking to fellow agents in London, the significant tidal wave of growth seen from 2013 through to 2015 in the capital has subdued over the last six months.

However, as that central London house price wave has started to ripple out, agents are starting to see stronger property growth values in East Anglia and the South East regions outside of London, than what is being seen within the M25.

So, fellow Rotherham landlords and homeowners, is this the time to get your surfboards ready for the London wave?

Well, we in Rotherham haven’t really been affected by what is happening in the central London property mega bubble (i.e. Kensington, Chelsea, Marylebone, Mayfair etc.). The property market locally is more driven by sentiment, especially the ‘C’ word… confidence. The main forces for a weaker Rotherham property market relate to economic uncertainty surrounding the Brexit process, which I believe will impact unhelpfully on consumer confidence in the run up to and just after the serving of the Section 50 Notice by the end of Q1 2017.

In addition, the influence of reforms to the taxation of landlords is expected to result in a reduced demand from buy-to-let landlords, which will limit upward pressure on property values. However, on the other side of the coin, demand from tenants has been strong, but this has been counterbalanced by a strong supply of rental properties.

In my opinion, there is a slight risk of rents not growing as much in 2017 as they have in 2016, but by 2018 they will rise again to counteract Philip Hammond’s changes to tenant fees.

The broader Rotherham rental market looks relatively positive.

Modest rental growth is expected and rents might rise further if landlords begin to sell properties in an effort to offset to the impact of tax rises.

So what do I predict will happen to the Rotherham housing market in 2017? In Rotherham the growth of 2.5% for 2016 is set to fall to just 0.2% next year, then up 2.1% in 2018, 3.1% in 2018, 2.4% in 2019, 3.3% in in 2020 and finally 3.4% in 2021.

But these predictions do not take into account any effect of a possible snap General Election or further referendum on ratifying any Brexit deal (if that comes to pass in the future).

I’ll be staying alert and attentive to all movement in the property (and political spheres) – feel free to follow me on Twitter or Facebook for all the latest news and updates.

Dec 12, 2016

The semi-detached house with its bay windows and net curtains has long been ridiculed as an emblem of safe, lacklustre and desperately uncool suburban life…

but owners of these homes could have the last laugh…

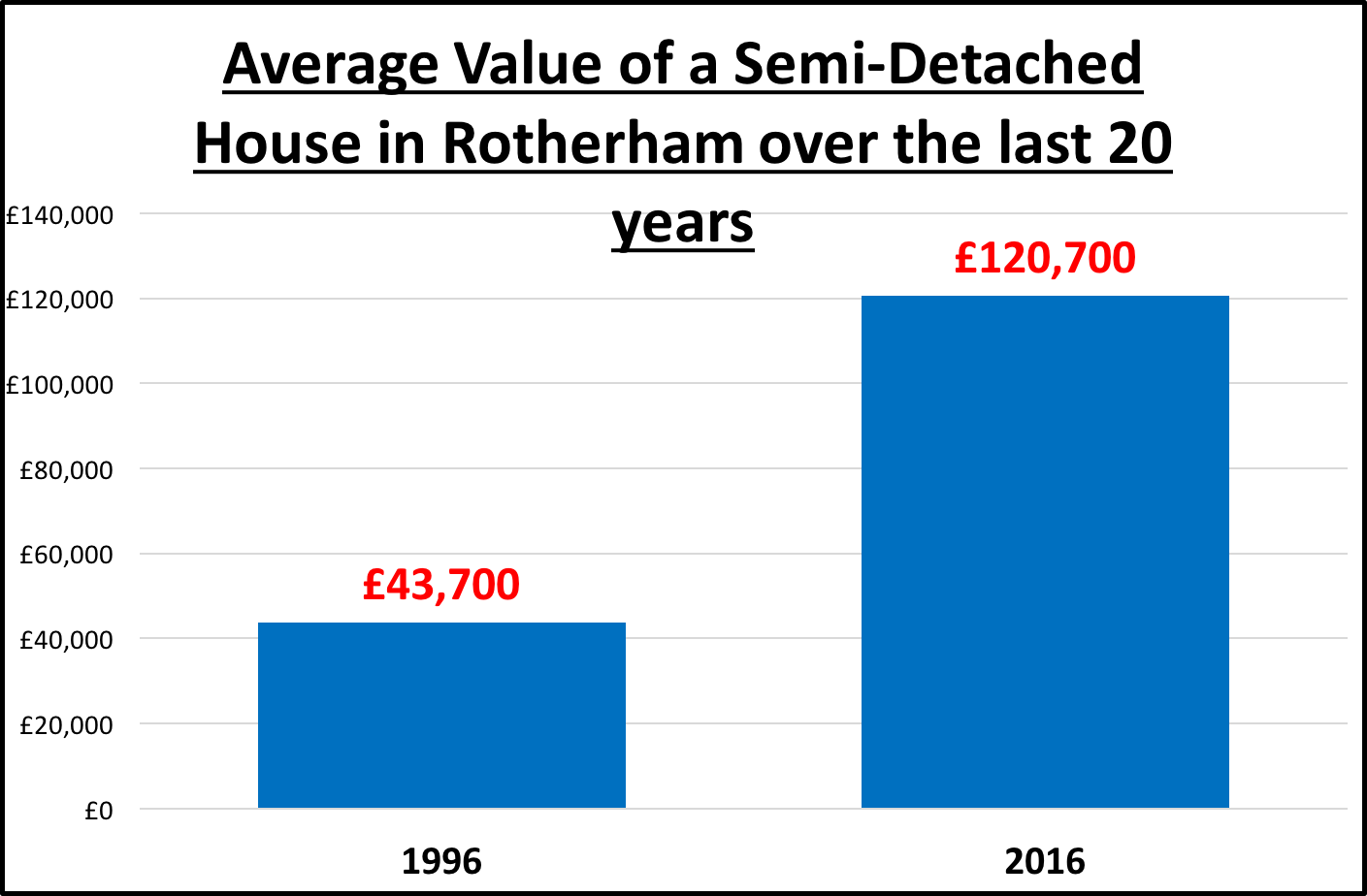

In the last 20 years the price of a semi-detached house in Rotherham rose by 176%, compared to its detached counterpart, which saw a smaller rise of 162% during the same period.

Smaller properties did fare the best – flats/apartments rose by a massive 347% and terraced houses rose by 215% – but this was because they were were starting from a lower base and demand from buy-to-let landlords has had a big part in driving the values on that type of house (i.e. the price a buy-to-let landlord is prepared to pay is driven by the rent the landlord can achieve).

In 1996 the average value of a semi-detached stood at £43,700,

…today it stands at £120,700

This is the attractiveness of semis – they are cheaper than detached houses but have most of the same benefits for families.

Semi-detached houses were built in their hundreds of thousands by the Victorians and Edwardians between the wars and through to the present day. Interestingly, in the late 19th Century and early 20th century they often weren’t referred to as semi-detached – but as villas!

So whilst Europeans live on top of each other in apartments the British chose, suburban comfort – being near (but not too near) the neighbours! I once heard someone say the semi-detached house was a peculiar crossbreed that doesn’t stand on its own — it is inseparable from its neighbour — yet somehow still embodies a dream of suburban independence.

Nearly one in two houses in Rotherham are semi-detached houses.

There are 22,572 semi-detached properties in Rotherham and they represent 49.22% of all the households in Rotherham.

Rotherham has such a mix of semi-detached properties.

There are the older classic bay fronted semis all the way through to more modern ones built in the last couple of decades.The older ones offered a hall to provided separation between the reception rooms and privacy for their occupants. Also the downstairs offered larger rooms to accommodate dining tables, whilst upstairs, bedrooms were smaller, yet cosy.

However, probably the most overlooked aspect of popularity for semis is the garden. The front garden was designed to separate the house from the world and the back garden designed for private relaxation. The semi in the suburbs was relaxing, well presented, plumbed and enhanced by a garden so that when a window was opened the air had a chance of being genuinely fresh…

…and it’s for all those reasons why 791 semi-detached houses have been sold in Rotherham in the last 12 months alone.

Still as popular today as they were with the Victorians all those years ago – some things just stand the test of time!

For more information and insight into the Rotherham property market please follow me on Twitter and Facebook.

Nov 23, 2016

The Bank of England’s latest figures show that in the first half of 2016, £128.73bn was lent by UK banks to buy property. This is impressive when you consider only £106.7bn was lent in the first half of 2015.

Even more interesting, was that most of the difference was in Q2, as £68.12bn was lent by banks in new mortgages for house purchase – this is the highest it has been for two years. Looking locally, in Rotherham last quarter, £424.6m was loaned on S60 properties alone!

Even though the Bank won’t be releasing the Q3 figures until December 2016, the HMRC have published their own preliminary data to suggest Q3 will be even better – with a massive growth of buy-to-let landlords to the housing market in that time frame.

This is fascinating as it seems to fly in the face of the popular narrative – that the uncertainty surrounding Brexit would negatively impact buyer sentiment.

And it’s not just buy-to-let landlords that seem to be flourishing.

I am finding that first-time buyers are also a lot more confident too.

Low, and now negative, inflation has had a tangible impact on household finances and first-time buyers feel more secure in their jobs. Couple this reality with a low interest rate environment and you have all the ingredients for a strengthening property market.

To back that up with numbers, of the £68.12bn of mortgages lent in the Quarter (Q2), £14.9bn was lent to first-time buyers. This is the highest proportion of that overall lending for over two years (at 21.99%).

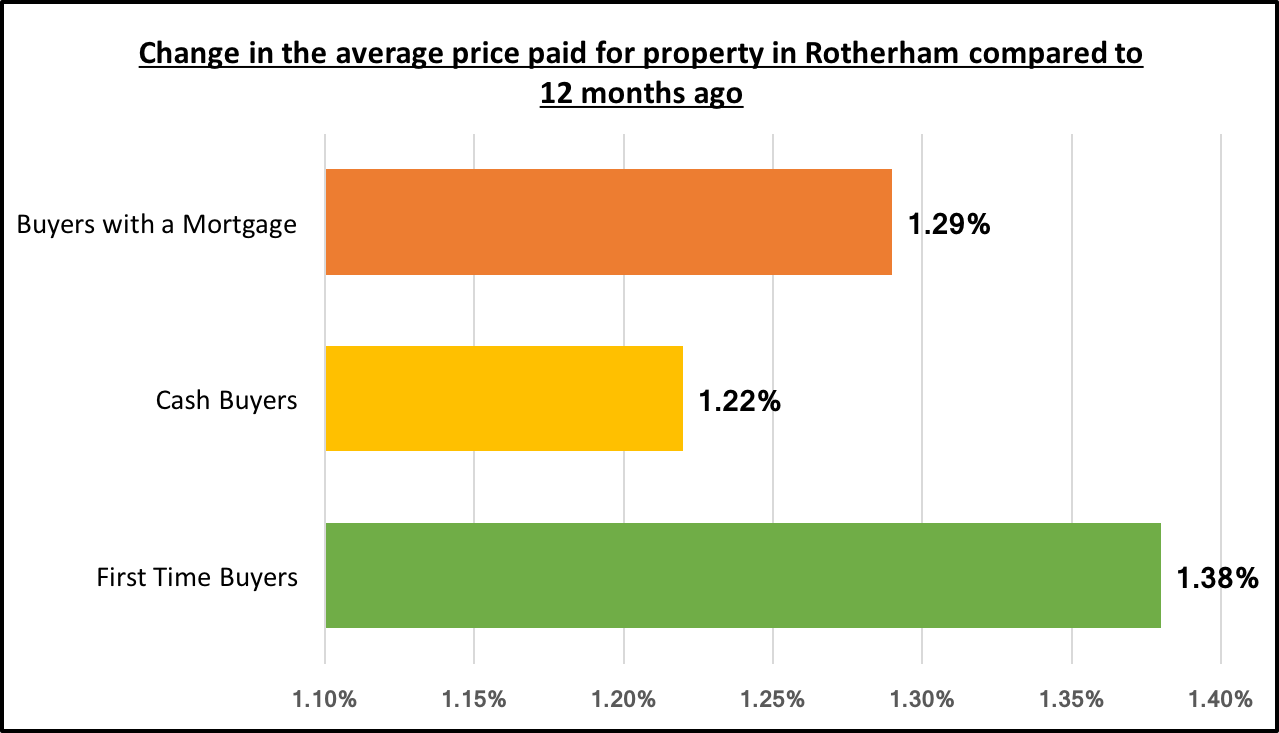

When I looked at the data for Rotherham Metropolitan Borough Council area, the average price paid by first-time buyers (FTBs) was £108,494, which is a rise of 0.82% from last month and a rise of 1.38% to twelve months ago.

The Land Registry then categorise the remaining buyers into cash buyers or those buying with a mortgage. The average price paid by cash buyers was £113,614, a rise of 0.73% from last month and a rise of 1.22% to twelve months ago, whilst buyers with mortgages (but not FTBs), the average price paid by them was £127,326, a rise of 0.71% from last month and a rise of 1.29% to twelve months ago.

What surprised me with these figures was how close the property prices, values and percentages were to each other.

It just goes to show the combination of low mortgage rates and a stable job market will continue to have a positive effect on the Rotherham and UK market.

And that is why, while there is definitely more cautiousness in the market at present than a year or so ago (among borrowers and mortgage companies alike), mortgage rates are so competitive that they are inducing people to commit to a home purchase.

It seems the great Brexit uncertainty was over hyped.

House price growth, as well as mortgage approvals, could pick up pace into 2017.

For the latest news and insights into the Rotherham property market feel free to follow me on Facebook or Twitter. If you would like any advice about property that you are interested in I am always happy to help – please get in touch with me!

Nov 19, 2016

Let’s talk about Stamp Duty.

Apart from some minor exemptions, Stamp Duty is paid by anyone buying a property over £125,000 in the UK.

It presently raises £10.68bn a year for HM Treasury (interesting when compared with £27.6bn in fuel duty, £10.69bn in alcohol duty and £9.48bn in tobacco duty).

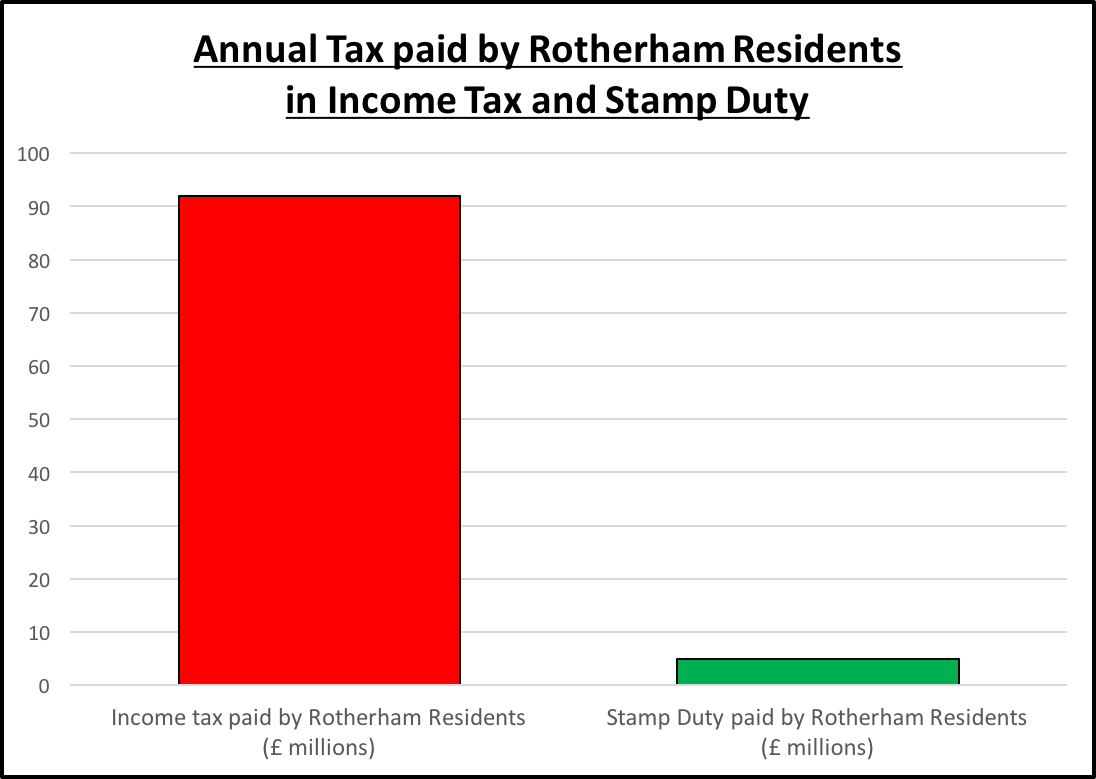

In the latest set of data from HMRC, in the MP constituency that covers Rotherham, property buyers paid £5m stamp duty in one year alone – a lot of money in anyone’s eyes (although not as much as the £92m in income tax that all of us in the same area paid last year).

However, as you may know, George Osborne introduced an additional tax for landlords and from April 2016 they had to pay an additional 3% stamp duty surcharge on top of the normal stamp duty rate when purchasing a buy-to-let property. There were tales of woe predicted, with a report by Deutsche Bank suggesting that the new surcharge could see house prices fall by as much as 20%.

HMRC data released in the Summer for Quarter 2 (Q2) of 2016 did seem to back up those fears as they published some worrying figures; only one in seven properties purchased was a second home or buy-to-let (in real numbers, only 30,300 of the 207,900 properties in Q2 were bought by landlords).

In previous articles, I spoke about the slump of property transactions after the 1st of April. Landlords rushed through their property purchases in March to beat the April deadline. In Q2 of 2016, £1.976bn was raised in Stamp Duty from Residential Property. Of that £1.976bn, £652m was paid by buy-to-let landlords (£424m in normal stamp duty and £228m in the additional 3% surcharge).

However, looking at Q3, the numbers have improved significantly.

Of the 235,000 property sales, nearly one in four of them (56,100 to be precise) were bought by buy-to-let landlords and of the £2.208bn in stamp duty, £864m was paid in ‘normal’ stamp duty and an impressive £442m paid by those same landlords in the additional stamp duty surcharge.

The statistics suggest buy-to-let investors have thankfully not been deterred by the stamp duty surcharge introduced in April this year.

The figures also show that 65.4% of “buy-to-let” purchases cost less than £250,000, 23.7% of properties were in the £250k to £500k range and 10.9% (or 6,100 additional properties) of buy-to-let properties bought cost over £500k – interestingly nearly one in four (22.2%) of £500k properties purchased in Q3 were buy to let properties.

It just goes to back up what I stated a few weeks ago when I suggested that many investors had rushed to make purchases before 31st March, This made figures in the following months (Q2) artificially low when the 3% supplement was introduced, but in Q3 the number of buy-to-let properties purchased increased by 85%.

It just goes to show you shouldn’t believe everything you read in the newspapers! I can assure you the Rotherham property market is doing just fine.

Please get in touch for more information about Rotherham and the property market. For more frequent thoughts and opinions, please visit my Twitter and Facebook pages!

Nov 15, 2016

Back in the Spring, there was a surge in landlords buying buy-to-let property in Rotherham as they tried to beat George Osborne’s new stamp duty changes which kicked in on the 1st April 2016.

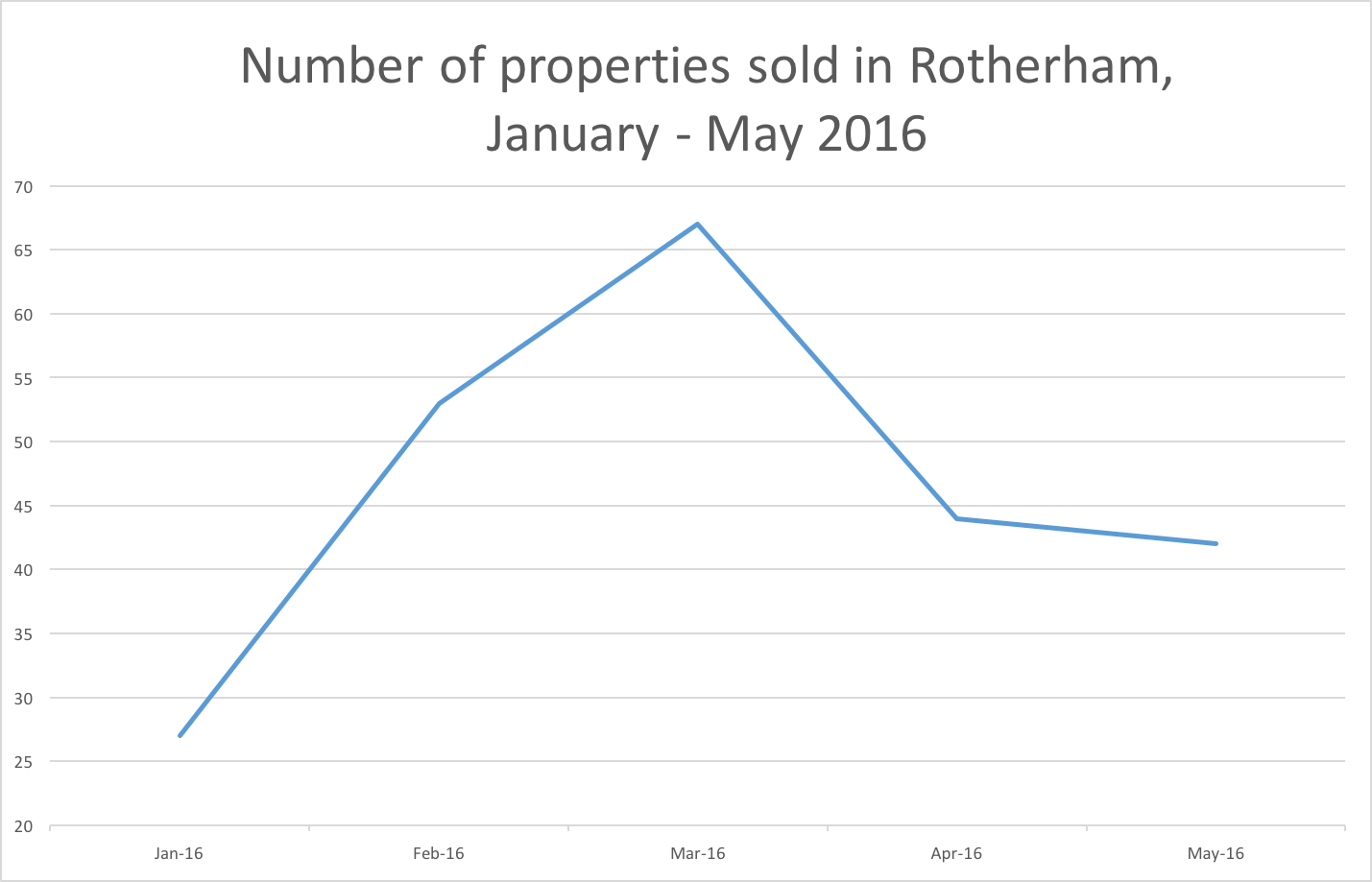

To give you an idea of the sort of numbers we are talking about, below are the property statistics for sales either side of the deadline in S60.

Jan 2016 – 27 properties

Feb 2016 – 53 properties

March 2016 – 67 properties

April 2016 – 44 properties

May 2016 – 42 properties

Source: Land Registry

Normally, the number of sales in the Spring months is very similar, irrespective of the month. However, as you can see, this year was a completely different picture as landlords moved their purchases forward to beat the stamp duty increase.

Usually, you would think that rents would be affected in a downwards direction.

However, there appears to be no apparent effect on the levels of rent being asked in Rotherham (and more importantly achieved).

This direction of rents is not likely to inverse any time soon

This is particularly due to legislation planned for 2017 that might reduce rental stock and push property values ever upward. The decline of buy-to-let mortgage interest tax relief will make some properties lossmaking, forcing landlords to pass on costs to tenants in the form of higher rents just to stay afloat. Even those who can still operate may be deterred from making further investments, reducing rental stock at a time of severe property shortage.

It’s not all bad news for tenants.

Whilst average rents in Rotherham since 2005 have increased by 16.7%, inflation has been 38.5% over the same time frame. This means Rotherham tenants are 21.8% better off in real terms when it comes to their rent (which is a sizeable chunk of most people’s monthly household budgets).

I found it particularly interesting looking at the rent rises over the last five years in Rotherham, as it was five years ago we started to see the very early green shoots of growth of the Rotherham economy. As a whole, since 2011, rents in Rotherham have risen by an average of 0.9% a year. This is fascinating!

The view I am trying to portray is that while renting is often seen as the unfavorable alternative to home ownership, many young Rotherham professionals like renting as it gives them adaptability with their life.

Rents will continue to rise which is good news for landlords as buy-to-let is an investment but, as can be seen from the statistics, tenants have also had a good deal with below inflation increases in rents in the past. It’s a win-win situation for everyone. Although on a very personal note, it’s imperative in the future that tenants are not thwarted from saving for a deposit by excessive rental hikes – there has to be a balance.

Rotherham landlords, property owners and those looking to get on the property ladder, please get in touch. For more thoughts and opinions on the Rotherham property market, please visit my Twitter and Facebook pages! Leave me a message and join in the conversation about the future of the Rotherham’s property market.

Nov 8, 2016

“How’s the Rotherham housing market doing?” asked one of our upbeat Rotherham landlords last week. “Quite strange”, I replied. Our landlord was a bit confused! Let me explain…

Even the Brexit vote has not fully hindered Rotherham’s steady rise in property value – property values in the area went down 0.92% last month but this still leaves Rotherham values 3.81% higher than a year ago and 8.9% higher than 20 months ago.

An increase in demand from buyers and an uninspiring level of supply (i.e. the number of properties on the market) has driven up the value of the Rotherham’s housing.

…and that is where the issue is.

Brexit, the coalition of the 2010-15, a double-dip recession and post-credit crunch fallout… I have been perplexed that the Rotherham property market (and values) has remained strong. That is until you start to look into the real reasons why we find ourselves in such a great place.

The Rotherham (and the UK) housing market is built on the foundations of basic economic rules that any A Level Economics student should understand. However, at a time when, as a country, we seem eager to uncouple ourselves from all manner of proven facts, anything is up for grabs.

Even the wary RICS said that most of its Chartered Surveyors in the UK anticipated house prices to increase in the next six months, which seems contradictory given economic cautions from Mr Hammond and HM Treasury.

- Inflation could rise to around 2% to 3% in 2017 and perhaps a little more in 2018 (due of Sterling’s devaluation)

- There’s a high probability of a decelerating GDP

- A slight rise in unemployment could be seen

So, how can the RICS and most of my landlords be so confident about the value of our homes?

Well, look at from where we are starting. Nationally, there’s a base of low unemployment, low inflation and preposterously low interest rates. In Rotherham, the local economy is doing quite well for itself. Confidence also plays a part. Confidence can supersede basic economic facts for a short time at least, which is why actual property market changes tend to be more exaggerated, as confidence can turn both positive and negative very quickly. The fact is, there is a long-term relationship between property values, wages and unemployment.

For example, looking at the graph below, you can quite clearly see the ratio of property values to earnings is nowhere near as high as it reached in 2008 and currently is in the middle of the range for the last 30 years.

As a country, we are in a good place.

By the end of March 2017, Article 50 will be invoked. This will bring additional political tomfooleries and economic ups and downs. With both purchasers and vendors predisposed by the 24-hour news cycle, which let’s face it, gets more haphazard by the day, it is likely to prove a challenging couple of years … and yes, Rotherham property values might drop slightly in 2017.

However, based on what we know currently, the UK and Rotherham property values are not projected to move that much over 2017 or 2018. Going into the next two years, we are in much better financial shape as a country compared to the last two crashes of 1987 and 2008.

But, on the other side of the coin, what we also know is that we don’t know much about the form of our economic future or indeed many other facets of our lives. Confidence will continue to be the key player in the Rotherham housing market for a while longer – yet this may possibly spur some much needed second-hand market activity.

Now, where is my crystal ball?

Follow me on Twitter or Facebook to find out! Or, at the very least, to gain the latest news and insights about property in Rotherham and South Yorkshire.